Factors Setting the Tone for Nutanix's (NTNX) Q3 Earnings

Nutanix NTNX is scheduled to release third-quarter fiscal 2021 results on May 26.

The Zacks Consensus Estimate for fiscal third-quarter revenues is pinned at $336.6 million, indicating 5.8% year-over-year growth.

The Zacks Consensus Estimate for loss is pegged at 47 cents per share for the quarter, which is significantly narrower than the year-ago quarter’s loss per share of 69 cents.

For the fiscal third quarter, Nutanix estimates ACV billings to lie between $150 million and $155 million. It projects non-GAAP gross margin to be around 81% in the quarter. Further, non-GAAP operating expenses are anticipated between $365 million and $370 million.

The company’s earnings beat estimates in all of the trailing four quarters, the average surprise being 26.2%.

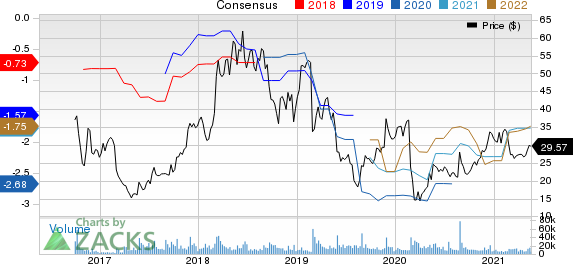

Nutanix Inc. Price and Consensus

Nutanix Inc. price-consensus-chart | Nutanix Inc. Quote

Factors to Consider

The company’s top line is likely to have benefited from increased demand for its hyper-converged solutions and automation services during the fiscal third quarter. Also, the ongoing shift to cloud solutions owing to the pandemic-induced remote-working wave is expected to have served as a key catalyst.

Nutanix continues to witness a strong adoption of its products. This trend is likely to have aided its quarterly performance. An increasing AHV (Acropolis Hypervisor Virtualization) adoption rate is anticipated to have boosted the top line.

The rise in the work-from-home trend, driven by the social-distancing norms related to the coronavirus pandemic, is spurring demand for virtual desktop infrastructure (VDI) and Daas solutions. This is likely to have been a positive for Nutanix during the quarter under review.

Moreover, the company’s business continuity program, FastTrack, is helping channel partners and global system integrators adapt to the changing demand patterns and the remote-working environment in the wake of the pandemic. This is likely to have helped Nutanix gain more buyers for its solutions in the quarter to be reported.

Besides, the company is managing expenses with various cost-reduction methods. This is expected to have been a tailwind to margins.

However, the ongoing transition to a subscription-based business model might have hurt Nutanix’s fiscal third-quarter top-line performance.

What Our Model Says

Our proven model predicts an earnings beat for Nutanix this time around. The combination of a positive Earnings ESP, and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of an earnings beat. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Nutanix currently carries a Zacks Rank of 3 and has an Earnings ESP of 1.76%.

Other Stocks With Favorable Combinations

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat in their upcoming releases:

Digital Turbine, Inc. APPS has an Earnings ESP of +6.98 and currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA Corporation NVDA has an Earnings ESP of +1.96% and carries a Zacks Rank #2, at present.

Pure Storage, Inc. PSTG has an Earnings ESP of +10.81% and currently carries a Zacks Rank of 3.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

Nutanix Inc. (NTNX) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.