Factors Setting the Tone for Splunk's (SPLK) Q4 Earnings

Splunk SPLK is set to report fourth-quarter fiscal 2020 results on Mar 4.

For the quarter, the Zacks Consensus Estimate for earnings has remained steady at 96 cents over the past 30 days, indicating growth of 3.23% from the year-ago quarter’s reported figure.

For fourth-quarter fiscal 2020, Splunk expects revenues of roughly $780 million. The consensus mark for revenues currently stands at $783.9 million, suggesting an increase of 26.02% from the year-ago quarter’s reported figure.

Notably, the company’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average positive surprise being 74.3%.

Let’s see how things have shaped up for this announcement.

Key Factors to Consider

Splunk’s portfolio strength has not only helped it win new customers but also expand its existing customer base. Solid demand for the company’s enterprise, security and cloud solutions is expected to have driven the top line in the to-be-reported quarter.

Notably, Splunk added 450 new enterprise customers in third-quarter fiscal 2020.

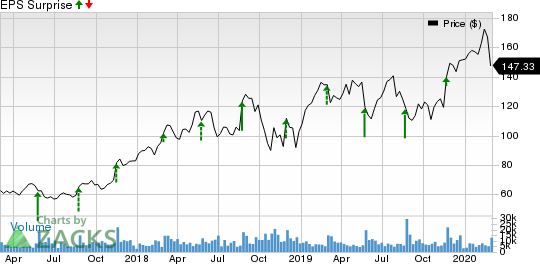

Splunk Inc. Price and EPS Surprise

Splunk Inc. price-eps-surprise | Splunk Inc. Quote

Additionally, Splunk’s solid partner base, comprising the likes of Amazon Web Services (AWS), Accenture, Cisco and Symantec, has been a key catalyst. Integration of its products in partner solutions is expected to have enhanced the company’s exposure, particularly among enterprise customers.

The top line is expected to reflect the impact of an expanding customer base, courtesy of a growing partner ecosystem.

Cloud revenues soared 78% from the year-ago quarter to $80 million in the last reported quarter. The momentum is expected to have continued in the fourth quarter on the back of increased utilization of cloud-based services.

Moreover, Splunk has been transitioning to a renewable model, which is expected to have driven the top line. Management expects the elimination of perpetual licenses to increase renewable mix to 99% in the fourth quarter and high 90% in fiscal 2020.

However, the transition is expected to have negatively impacted operating cash flow. Additionally, increasing cloud revenues in the product mix are expected to have kept margins under pressure in the to-be-reported quarter.

Q4 Development

On Dec 17, Splunk announced the expansion of its footprint to 11 global innovation hubs in locations across Canada, Poland, Singapore, the United Kingdom and the United States.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP along with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates. But that’s not the case here.

Splunk carries a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are three stocks you may want to consider, as our model shows that these have the right combination of elements to deliver an earnings beat this season.

Tencent Holding Ltd. TCEHY has an Earnings ESP of +6.03% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Guidewire Software, Inc. GWRE has an Earnings ESP of +15.38% and a Zacks Rank #3.

CrowdStrike Holdings Inc. CRWD has an Earnings ESP of +5.26% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

CrowdStrike Holdings Inc. (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research