Factors Setting the Tone for Yum! Brands (YUM) in Q1 Earnings

Yum! Brands, Inc. YUM is scheduled to report first-quarter 2018 numbers on May 2, before the opening bell. In the last reported quarter, the company delivered a positive earnings surprise of 20%. Also, it outpaced earnings estimates in each of the trailing four quarters, with an average beat of 10.7%.

What to Expect?

The question lingering in investors’ minds now is whether Yum! Brands’ will be able to deliver a positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate for the first quarter is pegged at 68 cents, higher than 65 cents in the year-ago quarter. Of late, the company’s earnings estimates have been stable.

Meanwhile, analysts polled by Zacks expect revenues of nearly $1,078 million, down more than 23.9% from the prior-year quarter.

Let’s delve deeper to find out how the company’s top and bottom lines will shape up this earnings season.

Factors at Play

Yum! Brands revenues in the first quarter might continue to be impacted by strategic refranchising initiative. Also, reduction in ownership through refranchising is expected to weigh on near-term revenues. In addition, the company remains highly exposed to various emerging nations in Latin America. These nations have been exhibiting decelerating growth for some time due to various macro headwinds, which may dent sales going ahead.

Meanwhile, Yum! Brands is focusing on building a superlative loyalty program with a large and growing database to help drive future sales. We believe that these initiatives should drive traffic and comps in the quarter to be reported. In the fourth quarter, the company implemented various digital features in mobile and online platforms across all its brand segments to enhance guest experience. Furthermore, the initial trends in foot traffic owing to the hot rewards royalty programs launched in August have been encouraging.

However, the strategic refranchising initiative is expected to reduce the company’s capital requirements, and facilitate earnings per share growth and ROE expansion. In the meantime, free cash flow is likely to continue growing, thus facilitating reinvestments to increase brand recognition and shareholder return. Remarkably, this shift to refranchising has been substantially benefiting the company’s operating margin over the years.

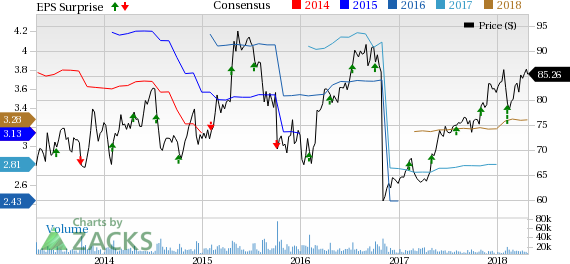

Yum! Brands, Inc. Price, Consensus and EPS Surprise

Yum! Brands, Inc. Price, Consensus and EPS Surprise | Yum! Brands, Inc. Quote

What Does the Zacks Model Unveil?

Our proven model does not show that Yum! Brands is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Yum! Brands’ has an Earnings ESP of -1.55%. Although, the company’s Zacks Rank #3 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings surprise.

Stocks to Consider

Here are a few other stocks from the Restaurant space that investors may consider, as our model shows that they also have the right combination of elements to post an earnings beat this quarter:

Ruth's Hospitality Group, Inc. RUTH has an Earnings ESP of +1.70% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Jack in the Box Inc. JACK has an Earnings ESP of +0.23% and a Zacks Rank of 3.

Brinker International, Inc. EAT has an Earnings ESP of +1.62% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Jack In The Box Inc. (JACK) : Free Stock Analysis Report

Ruth's Hospitality Group, Inc. (RUTH) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research