Fastly Stock Struggling to Break Above Pressure

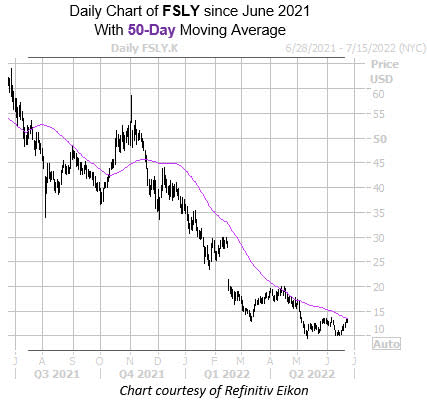

The shares of Fastly Inc (NYSE:FSLY) have struggled to rebound from their mid-May record low of $9.50, with $13.50 level providing a still ceiling for the last month. Plus, FSLY just ran into a historically bearish trendline that pressured the shares lower in the past.

According to Schaeffer's Senior Quantitative Analyst Rocky White's latest study, Fastly stock is now within one standard deviation of its 50-day moving average. The delivery name has seen six similar signals over the past three years, and was lower one month later 83% of the time, averaging an 18.6% loss for that period. A comparable move from the stock's current perch of $13.22 would place it below $11.

A shift in the options pits could also add pressure. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Fastly stock's 50-day call/put volume ratio of 2.81 ranks in the 72nd percentile of annual readings, which indicates a preference for bullish bets compared to the last 12 months.

Options look like the ideal avenue to pursue for those looking to speculate on FSLY, as it sports relatively cheap premium. This is per the equity's Schaeffer's Volatility Index (SVI) of 83%, which stands higher than 31% of readings from the past year. What's more, the security's Schaeffer's Volatility Scorecard (SVS) sits at a relatively high 80 out of 100, meaning the shares have exceeded option traders' volatility expectations during the past year.