February Growth Stocks To Look Out For

High growth companies such as Firan Technology Group and Aurinia Pharmaceuticals has a positive future outlook in terms of their returns, profitability and cash flows. The prospects of these companies tend to outperform others, regardless of how the stock market is generally doing. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

Firan Technology Group Corporation (TSX:FTG)

Firan Technology Group Corporation, together with its subsidiaries, supplies aerospace and defense electronic products and subsystems worldwide. Formed in 1983, and now led by CEO Bradley Bourne, the company employs 465 people and with the market cap of CAD CA$76.73M, it falls under the small-cap stocks category.

Want to know more about FTG? Check out its fundamental factors here.

Aurinia Pharmaceuticals Inc. (TSX:AUP)

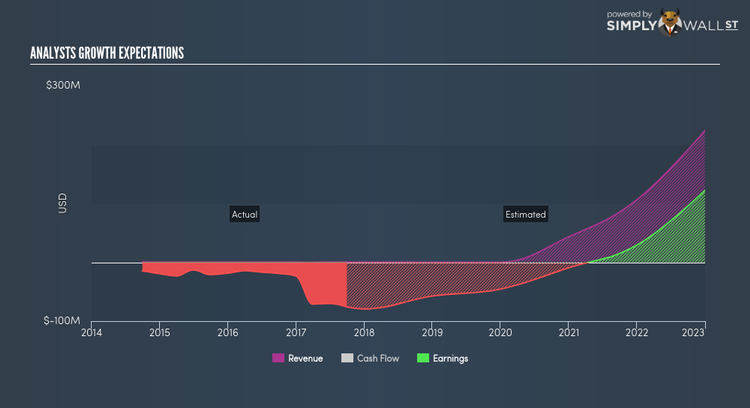

Aurinia Pharmaceuticals Inc., a clinical stage biopharmaceutical company, engages in the development of a therapeutic drug to treat autoimmune diseases in Canada and internationally. Established in 1993, and now run by Richard Glickman, the company provides employment to 20 people and with the company’s market cap sitting at CAD CA$537.93M, it falls under the small-cap category.

Thinking of investing in AUP? Take a look at its other fundamentals here.

Ballard Power Systems Inc. (TSX:BLDP)

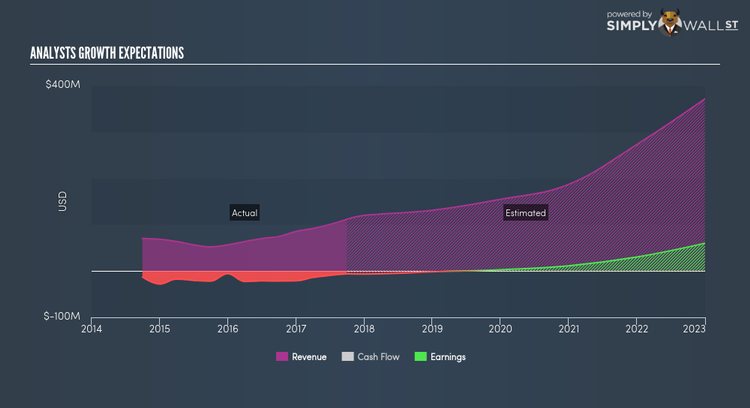

Ballard Power Systems Inc. engages in the design, development, manufacture, sale, and service of proton exchange membrane (PEM) fuel cells worldwide. Started in 1979, and now led by CEO R. MacEwen, the company size now stands at 395 people and has a market cap of CAD CA$694.44M, putting it in the small-cap group.

BLDP’s forecasted bottom line growth is an exceptional 62.28%, driven by the underlying double-digit sales growth of 33.07% over the next few years. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with top-line expansion. BLDP’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in BLDP? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.