February Housing, Inflation Data Help Dollar, Ease Tension Over US Economy

Talking Points:

- Second-best Building Permits print since end of recession – October 2013 was better.

- Weakest headline Consumer Price Index report since October 2013.

- Federal Reserve’s third $10B taper on pace for tomorrow.

The US Dollar has been one of the worst performing major currencies in 2014 as the combination of the Federal Reserve withdrawing stimulus and inclement weather culminated in the perfect storm for short-term weakness in the world’s largest economy. Yet as more recent data has come in, it seems the slowdown was more related to an interest rate shock – higher rates deterring investment and spending – rather than ‘just’ the weather.

The data out of the United States was mixed, but at a minimum points to the positive underlying momentum in the US housing market. Building permits – perhaps the best leading indicator for the housing market – showed their second best reading in the post-recession era (2009 to present). It could be a strong spring for the US economy based on the revisions seen to the prior data as well.

Here’s the data (including the rather benign CPI report) that’s impacted the US Dollar today:

- Consumer Price Index (FEB): +0.1% as expected unch (m/m); +1.1% versus +1.2% expected, from +1.6% (y/y).

- CPI ex Food & Energy (Core) (FEB): +0.1% as expected unch (m/m); +1.6% as expected unch (y/y).

- Building Permits (FEB): +7.7% (1018K) versus +1.6% (960K) expected, from -4.6% (945K) (m/m).

- Housing Starts (FEB): -0.2% (907K) versus +3.4% expected (910K), from -11.2% (909K) (m/m).

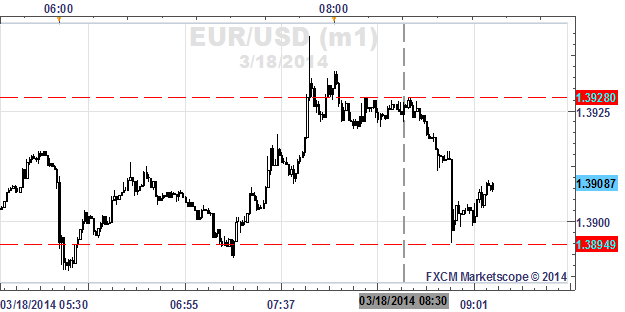

EURUSD 1-minute Chart: March 18, 2014 Intraday

Charts Created using Marketscope – prepared by Christopher Vecchio

Following the data, the EURUSD slipped from a near-session high of $1.3928 to as low as 1.3895. At the time this report was written, the pair was trading at 1.3909.

Read more: EUR/USD and USD/JPY Coil for Event-Driven Breaks

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.