February Top Materials Dividend Stock

A favourable economic condition has been a large driver of growth for companies in the materials industry. Therefore, this industry is a macroeconomic play with the opportunity of riding the wave in times of robust demand for commodities. Commodity prices are also a key determinant of these companies’ earnings, which in turn drives dividend payout and yield. If you’re a long term investor, these high-dividend materials stocks can boost your monthly portfolio income.

Labrador Iron Ore Royalty Corporation (TSX:LIF)

LIF has a decent dividend yield of 3.80% and pays 40.74% of it’s earnings as dividends , with analysts expecting a 107.55% payout in the next three years. Labrador Iron Ore Royalty’s earnings per share growth of 209.42% over the past 12 months outpaced the ca metals and mining industry’s average growth rate of 47.51%. Continue research on Labrador Iron Ore Royalty here.

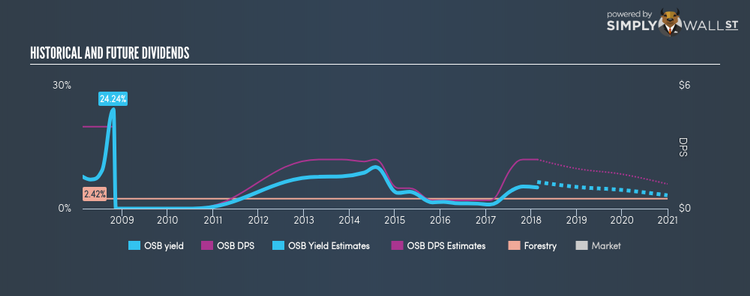

Norbord Inc. (TSX:OSB)

OSB has an appealing dividend yield of 5.19% and their payout ratio stands at 23.65% , with analysts expecting the payout in three years to be 38.24%. With a yield above the savings rate, bank account beating investors will be happy, but perhaps even happier knowing that OSB is in the top quartile of market payers. Norbord’s performance over the last 12 months beat the ca forestry industry, with the company reporting 138.25% EPS growth compared to its industry’s figure of 48.00%. More on Norbord here.

Methanex Corporation (TSX:MX)

MX has a nice dividend yield of 2.26% and pays out 32.25% of its profit as dividends . Despite there being some hiccups, dividends per share have increased during the past 10 years. When we compare Methanex’s PE ratio with its industry, the company appears favorable. The CA Chemicals industry’s average ratio of 18.6 is above that of Methanex’s (15.7). Continue research on Methanex here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.