FedEx Bears Could Double Their Money by July 4

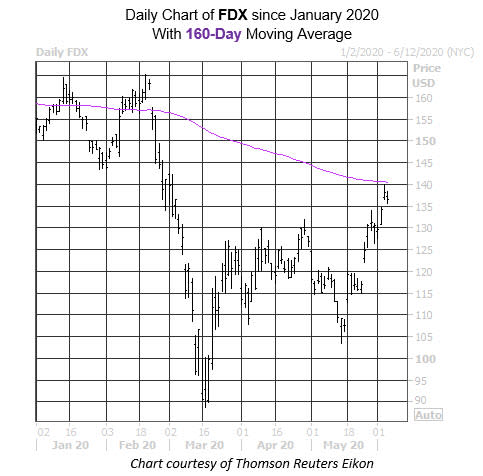

Shipping giant FedEx Corporation (NYSE:FDX) is in the news today, after announcing it was tacking on delivery fees to U.S. shipments. The move represents an effort to combat lagging business amid the coronavirus pandemic and subsequent shutdown of the economy. At last check, FDX is down 1% to trade at $136.61, but the trouble could just be getting started, with the stock brushing up to a historically bearish trendline.

Specifically, FDX is running into its 160-day moving average, which has acted as resistance over the past three years, according to Schaeffer's Senior Quantitative Analyst Rocky White. In the seven prior times this signal has sounded, FDX was down 10.3%, on average, one month out, with only one of the returns positive.

What's more, FedEx's Schaeffer's Volatility Index (SVI) is currently perched near its two-year average of 34.7%, last seen at 44%. Not only does the current ratio rank in the 21st annual percentile, suggesting short-term options premiums are relatively cheap at the moment, but White's modeling shows that an at-the-money FDX put option could potentially return 164% on another expected retreat from resistance at the 160-day trendline. In other words, prospective put buyers could more than double their money on a 10.3% drop in the shares, a month out.

FDX's 12.6% quarterly rally also seems to have stalled out at its -10% year-to-date breakeven level, which sits just below the aforementioned 160-day trendline. And further, the security's 14-Day Relative Strength Index (RSI) closed yesterday at 67 -- on the cusp of overbought territory -- indicating a short-term breather could be on its way.

There could also be optimism unwound in the options pits. FedEx's Schaeffer's put/call open interest ratio (SOIR) of 0.76 sits in the low 7th percentile of other readings from the past year. This suggests short-term option players have rarely been more call-biased in the past 12 months.