FedEx vs. United Parcel Service: Which Is a Better Buy?

When thinking of transportation and logistics, two companies – United Parcel Service UPS and FedEx FDX – typically come to mind. Both companies have fully established themselves in the market and have transformed into two of the world's most prominent shipping and logistics companies.

We see their delivery trucks everywhere. Collectively, they account for a vast majority of all parcels delivered. With the two companies having the same form of business, it’s sometimes difficult to differentiate which company would be the better investment – and that’s what we’re here to look at today.

To decide which company will provide a better bang for your buck, we can analyze key financial metrics, share performance, and recent earnings reports, while also looking at forecasted growth rates for the current and next fiscal year.

Share Performance

Upon viewing the year-to-date chart of both companies’ share performance, it is quickly apparent that there has been a disconnect between their share performance. FedEx shares have declined 23%, while UPS shares have shown a higher blend of defense, retracing around 17% during 2022.

Image Source: Zacks Investment Research

Once we widen the timeframe to over the last year, the disconnect becomes even more apparent; UPS shares have declined 15% in value while FedEx shares have taken much more of a beatdown, declining 34%, or nearly a third of their value.

Image Source: Zacks Investment Research

Clearly, UPS has been outperforming FedEx for some time now, which is indicative of the companies’ financial footing and investors’ sentiment towards both companies. The market has valued UPS shares much higher than FedEx shares.

Based on this data alone, one could conclude that UPS is the better investment, but there’s always more behind the curtain than just that. Additionally, past performance is not always indicative of future success.

Recent Earnings

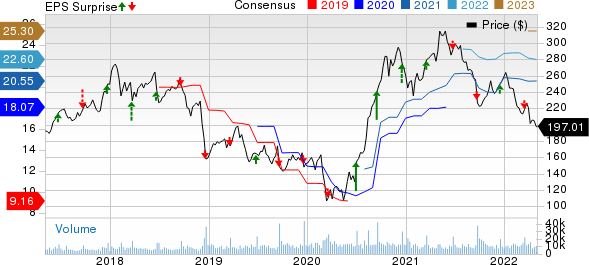

FDX’s last four quarterly reports are a bit uninspiring. The company has failed to exceed EPS expectations in three of its previous four quarterly reports, and in its most recent quarter, the company fell short of the Zacks Consensus Estimate by 2.1%. Additionally, over this timeframe, the average EPS surprise for the company is in the negative at -0.11%.

For the current fiscal year, the Zacks Consensus Estimate of $20.55 per share reflects year-over-year earnings growth of 13.2%, although the Consensus Estimate Trend has slipped 1.3% over the last 60 days. Next year’s EPS estimate sits at $22.60 per share, nearly a 10% year-over-year increase in earnings.

FedEx Corporation Price, Consensus and EPS Surprise

FedEx Corporation price-consensus-eps-surprise-chart | FedEx Corporation Quote

Pivoting to UPS, the story brightens up quite a bit. Over its last four quarterly reports, the company has exceeded EPS expectations each time, acquiring an average EPS surprise of 10%. UPS beat the Zacks Consensus EPS estimate in its latest quarter by nearly 7%.

The Zacks Consensus Estimate for the current year’s earnings of $12.82 per share reflects a 6% year-over-year increase in earnings, with the Consensus Estimate Trend inching up marginally higher over the last 60 days. Additionally, next year’s consensus EPS estimate of $13.23 per share displays a 3% increase in earnings year-over-year.

United Parcel Service, Inc. Price, Consensus and EPS Surprise

United Parcel Service, Inc. price-consensus-eps-surprise-chart | United Parcel Service, Inc. Quote

Once again, UPS handily beats out FedEx’s quarterly earnings reports, another factor as to why UPS shares have been outperforming.

Valuation

An unfavorable market throughout 2022 has undoubtedly sent shares of both companies on a downward trajectory. However, it has brought UPS and FDX to cheaper valuation levels.

FedEx’s current forward-earnings multiple sits at 9.6X, a fraction of its 2020 high of 23.8X and well below its median of 13.92X over the last five years. Additionally, the current value represents roughly a 48% discount relative to the S&P 500’s forward P/E of 18.6X.

Image Source: Zacks Investment Research

FedEx’s annual dividend yield is 1.52% and has a payout ratio of 16% of earnings. In three of the last five years, FedEx has increased its dividend, resulting in a five-year annualized dividend growth rate of 9.8%.

Looking at UPS, its current forward-earnings multiple sits at 13.9X, well below its 2020 high of 25.6X and comfortably below its median of 16.9X over the last five years. Furthermore, UPS’ forward P/E ratio also reflects a 25% discount relative to the S&P 500’s value.

Image Source: Zacks Investment Research

UPS enjoys rewarding its shareholders via its 3.4% dividend yield with a payout ratio sitting at 49% of earnings. The company has increased its dividend every year over the last five, giving it an annualized dividend growth rate of 7.1%.

Overall, FDX shares are currently cheaper relative to UPS shares. However, UPS has a notably higher dividend yield and is still trading at a discount relative to the general market.

Bottom Line

As shown in the charts, FedEx shares have struggled to keep pace with UPS shares. However, it’s not too confusing after looking at recent earnings reports and other financial metrics. UPS has managed to deliver consistently in each quarterly report, something that FedEx has mightily struggled with.

Flipping the pages back a few years, FedEx acquired TNT Express in May 2016 in a deal valued at $4.8 billion. The acquisition was expected to spur growth across Europe, but the company’s integration has been complicated for FedEx and has ended up costing them millions. Additionally, now former FedEx CEO Fred Smith left the company earlier this year.

The TNT Express acquisition has played spoilsport for FedEx, forcing them to constantly dish out cash to alleviate the problem and successfully integrate the company. Additionally, it’s worth noting that FedEx pushed UPS out of the bidding for TNT Express, something that UPS is most likely grateful for.

UPS has a much higher free cash flow, less restrictive operations, a higher dividend yield, and a stellar track record of quarterly reports. This, paired with the uplifting share performance relative to its peers, leads me to believe that UPS would be better suited for investors than FedEx. At the moment, FedEx is too tied up in integrating an acquisition that was supposed to fuel growth, not stunt it. This has weighed heavy on investors’ sentiment and is a driving force behind the poor FDX share performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research