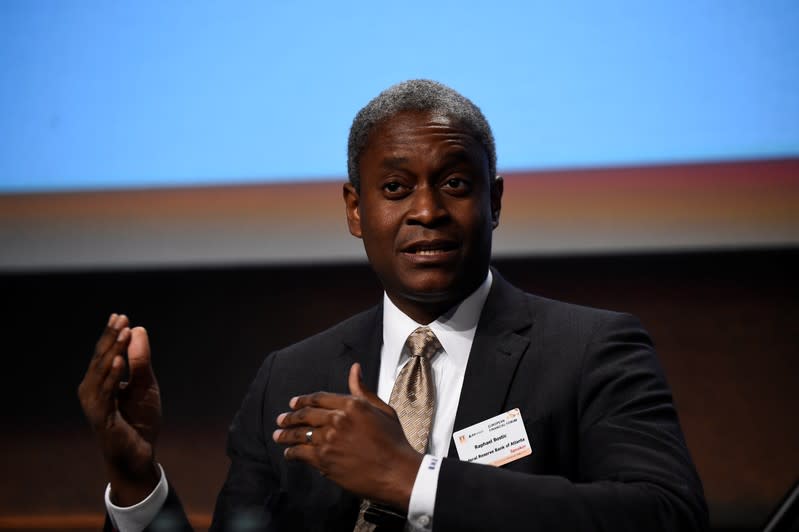

Fed's Bostic says he would have dissented against last rate cut, economy is solid

(Reuters) - Atlanta Federal Reserve Bank President Raphael Bostic said on Thursday that he would have probably dissented against the last rate cut if he had a vote in monetary policy because the U.S. economy is "solid" and not in need of easing.

Bostic still expects the economy to grow above trend and projects inflation will reach the Fed’s 2% target, he told reporters after an event organized by the Money Marketeers of New York University.

"Consumers are staying pretty rock solid," Bostic said, citing economic data and business surveys. He said current monetary policy is "accommodative" and there would need to be a "significant" shift in economic data for him to support either a rate cut or a rate increase.

The negative effects of the prolonged trade war with China have grown but they remain modest and are not yet hitting consumers, Bostic said.

"Many businesses that we’ve talked to basically said we're not going to pass that on, so we have not seen consumers face the tariffs,” he said. “When we do, that will be a new phase of the tariff war,”

Consumers are likely to continue to spend as long as the labour market remains strong, he said. And there are some signs the U.S. labour market may be a "bit beyond full employment" according to conversations with business leaders in his district, he said.

Some employers struggling to find workers are now relaxing their hiring standards by eliminating background checks, drug tests or job interviews, he said. Staffing agencies have reported that some new hires don’t show up for work because they have found better jobs.

One large food service company is even allowing people to start work the same day they apply, he said.

"I do think that the economy today is on solid footing and is likely to remain so," Bostic said. "I am fairly comfortable standing pat with policy and strongly favour weighing the incoming data, both macro and micro, over the coming months before deciding on any further adjustments."

Fed officials voted last week to lower the benchmark interest rate for the third time this year. Fed Chairman Jerome Powell and other policymakers characterized the rate reduction as the last of the central bank's "insurance" cuts.

The Fed's target rate is now at a range of 1.50% to 1.75%. Bostic does not vote in monetary policy decisions this year, though he participates in policy discussions, and he will become a voting member in 2021.

(Reporting by Jonnelle Marte; Editing by Leslie Adler & Shri Navaratnam)