FEMSA (FMX) Lags Q4 Earnings & Sales Estimates, Stock Falls

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, reported lower-than-expected results for fourth-quarter 2017 with both the top and the bottom lines lagging estimates. With this, the company has reported a negative earnings surprise in five of the trailing six quarters. Revenues topped estimates in three of the last four quarters.

Shares of FEMSA declined a marginal 0.6% following the soft results on Feb 28. However, FEMSA has outperformed the broader industry in the past year. The stock has returned 12.4%, surpassing the industry's gain of 6.3%.

Q4 Insight

Net majority income of 26 cents per ADS (Ps. 0.51 per FEMSA unit) in the fourth quarter was significantly below the Zacks Consensus Estimate of $1.08.

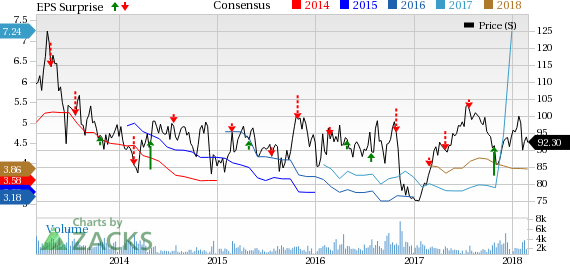

Fomento Economico Mexicano S.A.B. de C.V. Price, Consensus and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. Price, Consensus and EPS Surprise | Fomento Economico Mexicano S.A.B. de C.V. Quote

Net consolidated loss of the largest franchise bottler for The Coca-Cola Company KO was Ps. 9,699 million (net loss of US$512.4 million) against net income of Ps. 8,828 million (US$445.2 million) in the year-ago quarter. The unfavorable result can be attributed to the change in the accounting method for Coca-Cola FEMSA S.A.B. de C.V’s KOF Venezuelan operation. This resulted in the reclassification of a foreign currency translation charge in equity.

However, results gained from foreign exchange benefit associated with higher U.S. dollar-denominated cash position at FEMSA due to the sale of its partial stake in Heineken HEINY in September, as well as softness in Mexican peso during the quarter.

Total revenues increased 11.5% year over year to Ps. 122,502 million (US$6,471.3 million), fueled by solid performance across all segments, taking into account the consolidation of the Philippines and Vonpar’s integration at Coca-Cola FEMSA. On an organic basis, total revenues increased 3.5% year over year. However, the company’s total revenues in dollar terms lagged the Zacks Consensus Estimate of $6,552 million.

FEMSA’s gross profit grew 13.6% to Ps. 47,714 million (US$2,520.5 million). Gross margin expanded 70 basis points (bps) to 38.9% owing to improved gross margin across businesses.

FEMSA’s operating income rose 11.5% to Ps. 13,018 million (US$687.7 million). On an organic basis, operating income increased 6.5%. Consolidated operating margin remained flat at 10.6%.

Segmental Discussion

Total revenues at Coca-Cola FEMSA were up 11.6% year over year to Ps. 55,275 million (US$2,920 million). On a comparable basis, revenues improved 5.7% on the back of a rise in average price per unit case in Mexico and Argentina, along with higher volumes in the Brazil, Central America, the Philippines and flat volumes in Argentina. This was partly negated by volume declines in the company’s remaining operations.

Coca-Cola FEMSA’s operating income improved 5.8% to Ps. 7,584 million (US$400.6 million) in the quarter, while comparable operating income grew 13.3%. The segment’s reported operating margin contracted 80 bps to 13.7% mainly due to higher freight expenses, labor costs as well as diesel and gasoline prices.

FEMSA Comercio – Retail Division: Total revenues at this segment grew 10.1% year over year to Ps. 40,182 million (US$2,122.7 million). The rise can be mainly attributed to the opening of 527 net new OXXO stores in the quarter, which took the total net new store count in the past 12 months to 1,301. FEMSA Comercio’s Retail division had a total of 16,526 OXXO stores as of Dec 31, 2017. Same-store sales at OXXO increased 4.7% driven by strong consumer trends. Average customer ticket increased 2.7% while store traffic rose 1.9%.

Operating income rose 7.2% year over year to Ps. 4,379 million (US$231.3 million), with operating margin contracting 30 bps to 10.9% due to higher operating expenses.

FEMSA Comercio – Health Division: This segment reported total revenues of Ps. 12,571 million (US$664.1 million), up 2.3% year over year. The increase was backed by strong growth in South American business. The segment had a total of 2,225 point of sales across all regions, of which about 47 net new stores were added in the fourth quarter. Same-store sales for the drug stores rose 1.6%.

Operating income amounted to Ps. 623 million (US$32.9 million), up 4% year over year. Operating margin expanded 10 bps to 5%.

FEMSA Comercio – Fuel Division: Total revenues were up 26.4% to Ps. 10,177 million (US$537.6 million) on the back of growth in number of stations and the improved national prices established at the start of the year. Same-station sales rose 16.7% year over year, driven by 19.9% rise in average price per liter due to the aforementioned improvement in national prices, offset by a 2.7% decline in average volumes. The company had 452 OXXO GAS service stations as of Dec 31.

Operating income rose 50% to Ps. 111 million (US$5.9 million), while operating margin expanded 20 bps to 1.1% driven by higher gross margin as well as cost-controls and enhanced operating efficiency at its service stations.

Financial Position

FEMSA had cash balance of Ps. 96,944 million (US$4,911 million) as of Dec 31, 2017. Long-term debt was Ps. 110,917 million (US$5,618.9 million). Moreover, the company incurred capital expenditure of Ps. 7,881 million (US$416.3 million) in the fourth quarter due to increased investments in Coca-Cola FEMSA. Capital expenditure for the full year totaled Ps. 25,180 million (US$1,330.2 million).

Currently, FEMSA carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Heineken NV (HEINY) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research