FEMSA (FMX) Q2 Earnings Beat on Strength Across All Segments

Fomento Economico Mexicano S.A.B. de C.V’s FMX, alias FEMSA, reported net majority income per ADS of 82 cents (Ps. 1.58 cents per FEMSA unit) in second-quarter 2019, beating the Zacks Consensus Estimate of 80 cents.

Net consolidated income of the largest franchise bottler for The Coca-Cola Co. KO was Ps. 7,747 million (US$405.2 million), down 26% from the year-ago quarter. This decline was mainly due to a non-cash foreign exchange loss related to FEMSA’s U.S. dollar-denominated cash position in second-quarter 2018 that was impacted by the appreciation of the Mexican peso. However, results benefited from rise in income from operations.

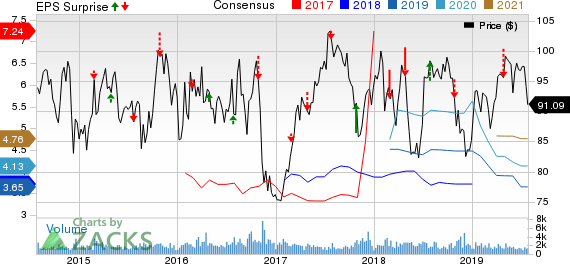

Fomento Economico Mexicano S.A.B. de C.V. Price, Consensus and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. price-consensus-eps-surprise-chart | Fomento Economico Mexicano S.A.B. de C.V. Quote

Total revenues increased 9.4% year over year to Ps. 128,123 million (US$6,701 million), mainly fueled by robust growth across all operations. On an organic basis, total revenues increased 6.7%.

Shares of FEMSA did not react much to the second-quarter 2019 results. However, this Zacks Rank #5 (Strong Sell) stock has declined 5.7% in the past three months against the industry’s growth of 3.2%.

FEMSA’s gross profit grew 9.7% to Ps. 47,896 million (US$2,505 million). Gross margin expanded 10 basis points (bps) to 27.49%, owing to gross margin expansion of 180 bps each at FEMSA Comercio’s Proximity and Fuel Divisions. This was partly negated by declines at Coca-Cola FEMSA and FEMSA Comercio’s Health Division.

FEMSA’s operating income improved 8.3% to Ps. 11,936 million (US$624.3 million). On an organic basis, operating income rose 6.6%. Consolidated operating margin contracted 10 bps to 9.3% due to declines in margins at Coca-Cola FEMSA and FEMSA Comercio’s Health Division.

Segmental Discussion

FEMSA Comercio — Proximity Division: Total revenues for this segment grew 11.3% year over year to Ps. 47,190 million (US$2,468.1 million). Organic revenues for the segment were up 11%. This rise can primarily be attributed to the opening of 375 net new OXXO stores in the reported quarter, which has taken the net new store openings to 1,312 in the past 12 months.

FEMSA Comercio’s Proximity division had 18,608 OXXO stores as of Jun 30, 2019. Same-store sales at OXXO increased 6.2%, driven by 7.5% rise in average customer ticket, offset by 1.1% decline in store traffic.

Operating income rose 15.4% year over year while operating margin expanded 30 bps to 9.8%. Revenue gains were partly offset by higher operating expenses, stemming from the gradual shift to employee-based store teams, higher secure cash handling costs, consolidation of Caffenio and continued efforts to strengthen the compensation structure of in-store personnel.

FEMSA Comercio — Health Division: This segment reported total revenues of Ps. 15,246 million (US$797.4 million), up 13.9% year over year. Organic revenues for the segment were up 0.1%. This increase was backed by steady trends in Mexico and Chile, offset by negative currency translations due to the appreciation of Mexican peso compared with Chilean and Colombian pesos. The segment had 3,061 points of sales across all regions, of which, about 677 net new stores were added in the second quarter, including the integration of Corporación GPF. Same-store sales for drugstores dropped 2.6% due to the effects of the aforementioned negative currency.

Operating income declined 3% year over year, with operating margin contracting 70 bps to 4.4%, driven by lower gross margin and operating expense deleverage due to the integration of Corporación GPF, which has a relatively higher operating expense structure. This was partly negated by cost efficiencies and stringent expense management across regions.

FEMSA Comercio — Fuel Division: Total revenues increased 7.8% to Ps. 12,415 million (US$649.3 million). Same-station sales were flat as pricing gains were offset by a decline in average volume. The company had 541 OXXO GAS service stations as of Jun 30, including one OXXO GAS station added in the second quarter. Operating income rose 32.6%, with 40-bps expansion in operating margin to 2.3%.

Total revenues at Coca-Cola FEMSA S.A.B. de C.V. KOF increased 7.6% year over year to Ps. 47,978 million (US$2,509.3 million). On a comparable basis, revenues improved 11.6%. The top line for the segment benefited from robust price increases, revenue management initiatives across regions, and volume growth in Brazil, Central America and Colombia. This was partially offset by negative translation effect of all of its operating currencies compared with the Mexican peso.

Coca-Cola FEMSA’s operating income increased 6.5% while comparable operating income rose 13.8%. However, the segment’s operating margin contracted 20 bps to 13.2%, owing to restructuring severance in Argentina, Central America, Colombia and Mexico. This was partly offset by operating expense leverage and freight efficiencies in Brazil and Mexico.

Financial Position

FEMSA had cash and cash equivalents of Ps. 70,472 million (US$3,669 million) as of Jun 30, 2019. Long-term debt was Ps. 96,565 million (US$5,027 million). Moreover, the company incurred capital expenditure of Ps. 10,220 million (US$533.1 million) in the first half of 2019, reflecting increased investments in most businesses.

Want A Better-Ranked Beverage Stock? Check This

PepsiCo Inc. PEP has an expected long-term earnings growth rate of 7% and a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Pepsico, Inc. (PEP) : Free Stock Analysis Report

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

To read this article on Zacks.com click here.