Fidelity National (FNF) to Report Q1 Earnings: What's in Store?

Fidelity National Financial, Inc. FNF is slated to report first-quarter 2022 results on May 10, after market close. The company delivered an earnings surprise in all the four reported quarters of 2021.

Factors to Note

Premiums in the to-be-reported quarter are expected to have increased on higher direct premium, agency premiums as well as escrow, title-related and other fees.

Being the nation’s largest title insurance and settlement services company, Fidelity National has a leading market share in the residential purchase, refinance, and commercial markets.

FNF is likely to have benefited from strong origination demand and continued rebound in commercial real estate activity in a still-low interest rate environment.

Higher order volumes are likely to have aided its commercial performance.

Expanded distribution channel and attractive spreads despite the low interest rate environment are expected to have aided sales at F&G. Assets under management is expected to have benefited from solid retail annuity sales and F&G's interest in institutional markets.

The Zacks Consensus Estimate for earnings per share is pegged at $1.30, indicating a decrease of 16.7% from the year-ago reported figure. The consensus estimate for revenues is pegged at about $3 billion, indicating a decline of 4.6% from the year-ago reported figure.

Expenses are likely to have increased attributable to higher personnel costs and other expenses.

However, investments in technology, operations and automation are likely to have aided margin.

Quantitative Model Prediction

Our proven model does not conclusively predict an earnings beat for Fidelity National this time around. The stock needs to have the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case as you can see below.

Earnings ESP: It has an Earnings ESP of 0.00%. This is because both the Zacks Consensus Estimate and the Most Accurate Estimate are pegged at $1.30. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

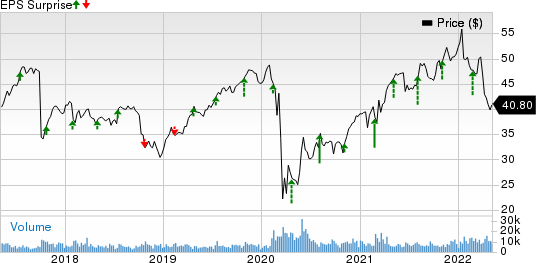

Fidelity National Financial, Inc. Price and EPS Surprise

Fidelity National Financial, Inc. price-eps-surprise | Fidelity National Financial, Inc. Quote

Zacks Rank: Fidelity National currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Some stocks from the insurance industry with the perfect mix of elements to surpass estimates in their upcoming quarterly releases are as follows:

ProAssurance PRA has an Earnings ESP of +27.54% and a Zacks Rank #3. The Zacks Consensus Estimate for the first quarter is pegged at 17, indicating an increase of 325% from the year-ago reported figure.

ProAssurance delivered an earnings beat in all the reported quarters of 2021.

Conifer CNFR has an Earnings ESP of +23.08% and a Zacks Rank #3. The Zacks Consensus Estimate for the first quarter is pegged at a loss of 13 cents, narrower than the year-ago reported loss of 72 cents.

Conifer earnings missed estimates in three quarters of 2021 while coming in line with the same once.

Lemonade LMND has an Earnings ESP of +2.66% and a Zacks Rank #3. The Zacks Consensus Estimate for the first quarter is pegged at a loss of $1.43 per share, wider than the year-ago reported loss of 81 cents.

Lemonade delivered an earnings beat in one of the four quarters of 2021, while missing in three.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF) : Free Stock Analysis Report

Conifer Holdings, Inc. (CNFR) : Free Stock Analysis Report

Lemonade, Inc. (LMND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research