Financial Dividend Stocks That Will Add Value To Your Portfolio

The fortunes of financial services companies often follow that of the broader economy. Firms in this sector offer services ranging from investment banking to consumer finance. Downturns can hit financial services companies hard as net interest margins shrink and credit losses grow. However, in good times, they report steady profits and many pay attractive dividends. As a long term investor, I favour these financial stocks with great dividend payments that continues to add value to my portfolio.

Laurentian Bank of Canada (TSX:LB)

LB has a juicy dividend yield of 4.42% and pays out 45.54% of its profit as dividends . In the case of LB, they have increased their dividend per share from $1.28 to $2.52 so in the past 10 years. Much to the delight of shareholders, the company has not missed a payment during this time.

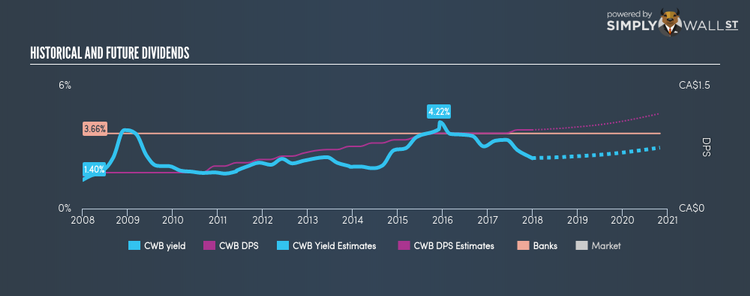

Canadian Western Bank (TSX:CWB)

CWB has a nice dividend yield of 2.46% and is distributing 38.32% of earnings as dividends . CWB’s last dividend payment was $0.96, up from it’s payment 10 years ago of $0.4. It should comfort existing and potential future shareholders to know that CWB hasn’t missed a payment during this time.

Genworth MI Canada Inc. (TSX:MIC)

MIC has a large dividend yield of 4.04% and is paying out 30.18% of profits as dividends , with analysts expecting a 41.23% payout in three years. The company’s 4.04% dividend is both above the low risk savings rate and among the markets top payers. Genworth MI Canada’s earnings per share growth of 42.98% over the past 12 months outpaced the ca mortgage industry’s average growth rate of 1.49%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.