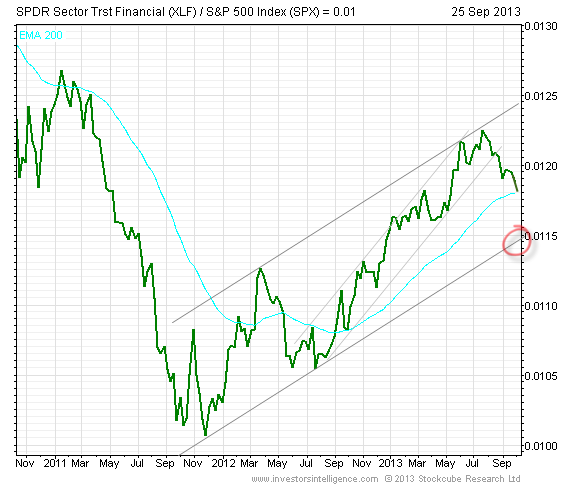

Financial Sector ETF Hits Highest Level Since March 2011

Financial Select Sector SPDR (XLF) climbed to a new 52-week high on Wednesday to levels not seen in nearly two years after beating the market by a wide margin in 2012.

XLF was a top sector ETF performer last year with a gain of nearly 30% as bank stocks shook off worries over the global economy, European debt crisis and U.S. deficit. The financial fund enjoyed a strong 2012 after dropping about 17% the previous year.

The sector ETF enjoyed its best year since 2003 when it zoomed 31.5%, according to Morningstar. [Bank Bulls Drive Year-End Breakout Hopes in Financial ETF]

Warren Buffett’s Berkshire Hathaway outperformed the S&P 500 in 2012 thanks in part to his big bet on Bank of America (BAC).

BAC shares more than doubled last year, making it one of the best performers in the Dow Jones Industrial Average, according to Yahoo Finance’s Daily Ticker. BAC is the fourth-largest holding in XLF, the financial ETF, at 6.3% of the portfolio. The fund also has 8.3% in Berkshire Hathaway.

The recent rally has carried XLF to its highest levels since March 2011 although the ETF still remains well below its all-time peak set before the global financial crisis.

For example, the financial ETF briefly rose above $38 a share in May 2007. On Wednesday, it traded as high as $16.90 a share.

Financial Select Sector SPDR

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.