Financially Sound Stocks Selling At A Discount

Stocks recently deemed undervalued include Atalaya Mining and AssetCo, as they trade at a market price below their true valuations. Investors can determine how much a company is worth based on how much money they are expected to make in the future, or compared to the value of their peers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them good investments if you believe the price should eventually reflect the stock’s actual value.

Atalaya Mining Plc (AIM:ATYM)

Atalaya Mining Plc, together with its subsidiaries, explores for and develops metal properties in Europe. Started in 2004, and headed by CEO Alberto Lavandeira Adán, the company provides employment to 370 people and has a market cap of GBP £333.73M, putting it in the small-cap group.

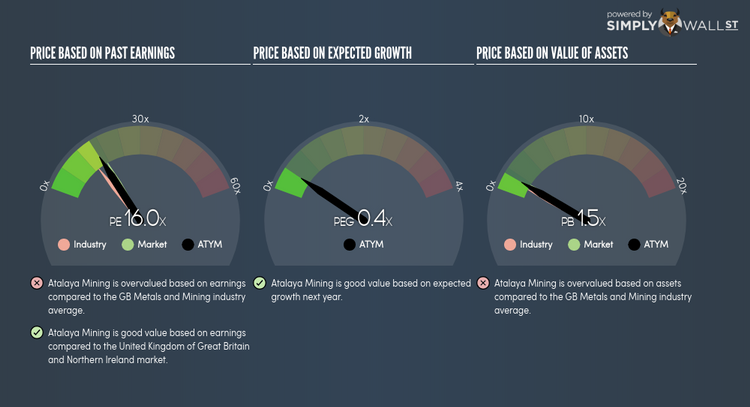

ATYM’s shares are now hovering at around -79% lower than its actual value of €11.49, at the market price of UK£2.44, based on my discounted cash flow model. This discrepancy gives us a chance to invest in ATYM at a discount. Also, ATYM’s PE ratio stands at 15.99x while its index peer level trades at, 17.3x implying that relative to its comparable set of companies, ATYM’s shares can be purchased for a lower price. ATYM is also in great financial shape, with current assets covering liabilities in the near term and over the long run. ATYM also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. More on Atalaya Mining here.

AssetCo plc (AIM:ASTO)

AssetCo plc engages in the provision of management and resources to the fire and rescue emergency services in the Middle East and internationally. Formed in 2003, and currently run by , the company provides employment to 240 people and with the company’s market cap sitting at GBP £50.07M, it falls under the small-cap category.

ASTO’s stock is currently hovering at around -70% less than its real value of £13, at a price tag of UK£3.95, based on my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Also, ASTO’s PE ratio is around 22.2x while its Commercial Services peer level trades at, 22.51x implying that relative to its competitors, we can invest in ASTO at a lower price. ASTO is also strong in terms of its financial health, as current assets can cover liabilities in the near term and over the long run. ASTO has zero debt on its books as well, meaning it has no long term debt obligations to worry about. More detail on AssetCo here.

Lloyds Banking Group plc (LSE:LLOY)

Lloyds Banking Group plc provides banking and financial services under the Lloyds Bank, Halifax, Bank of Scotland, and Scottish Widows brands in the United Kingdom and internationally. Established in 1695, and now run by António de Sousa Horta-Osório, the company size now stands at 67,905 people and with the stock’s market cap sitting at GBP £45.68B, it comes under the large-cap category.

LLOY’s stock is currently hovering at around -35% beneath its value of £0.95, at the market price of UK£0.62, based on its expected future cash flows. This difference in price and value gives us a chance to buy low. Also, LLOY’s PE ratio is trading at around 11.76x compared to its Banks peer level of, 14.93x suggesting that relative to other stocks in the industry, you can purchase LLOY’s stock for a lower price right now. LLOY is also in great financial shape, as short-term assets amply cover upcoming and long-term liabilities.

Interested in Lloyds Banking Group? Find out more here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.