Financially Sounds Stocks Poised For High Growth

Want to add more growth to your portfolio but not sure where to look? Companies such as Square and Align Technology are deemed high-growth by the market, with a positive outlook in all areas – returns, profitability and cash flows. Whether it be a well-known tech stock or a risky small-cap, I believe diversification towards growth can add value to your current holdings. Below I’ve compiled a list of stocks with a bright future ahead.

Square, Inc. (NYSE:SQ)

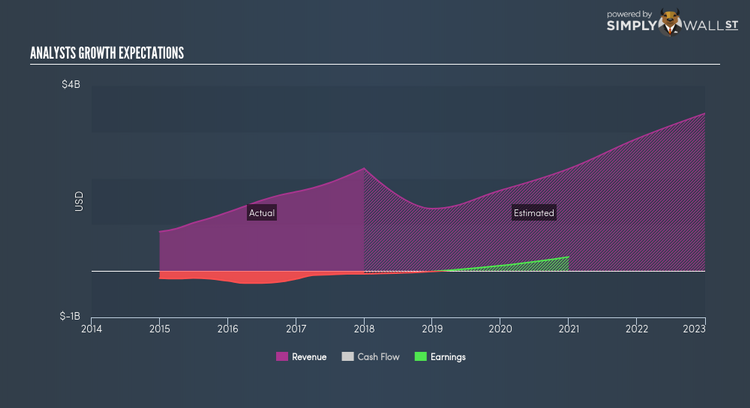

Square, Inc. provides payment and point-of-sale solutions in the United States and internationally. Founded in 2009, and currently run by Jack Dorsey, the company employs 2,338 people and with the company’s market capitalisation at USD $19.47B, we can put it in the large-cap stocks category.

SQ’s projected future profit growth is an exceptional 89.58%, with an equally strong underlying growth from its cash flow from operations expected over the upcoming years. An affirming signal is when net income increase is supported by operating cash flow growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 32.39%. SQ ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering SQ as a potential investment? Other fundamental factors you should also consider can be found here.

Align Technology, Inc. (NASDAQ:ALGN)

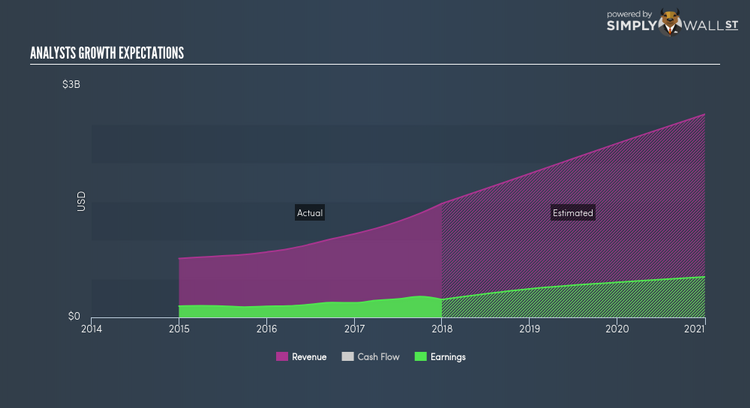

Align Technology, Inc. designs, manufactures, and markets a system of clear aligner therapy, intraoral scanners, and computer-aided design and computer-aided manufacturing (CAD/CAM) digital services. Founded in 1997, and now run by Joseph Hogan, the company currently employs 8,715 people and with the market cap of USD $21.85B, it falls under the large-cap stocks category.

ALGN is expected to deliver a buoyant earnings growth over the next couple of years of 25.26%, bolstered by an equally impressive revenue growth of 52.82%. It appears that ALGN’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 29.63%. ALGN’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add ALGN to your portfolio? Have a browse through its key fundamentals here.

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA)

Loma Negra Compañía Industrial Argentina Sociedad Anónima, together with its subsidiaries, manufactures and markets cement and its by-products in Argentina and Paraguay. Established in 1926, and currently run by Sergio Faifman, the company provides employment to 3,258 people and with the company’s market capitalisation at USD $2.55B, we can put it in the mid-cap stocks category.

LOMA’s forecasted bottom line growth is an optimistic double-digit 20.62%, driven by the underlying 57.76% sales growth over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 84.41%. LOMA ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering LOMA as a potential investment? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.