Financially Sounds Stocks Poised For High Growth

Robust, high-growth companies such as Richmont Mines are appealing to investors for many reasons. They bring about a strong upside to your portfolio, and less downside risk as opposed to financially challenged companies. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

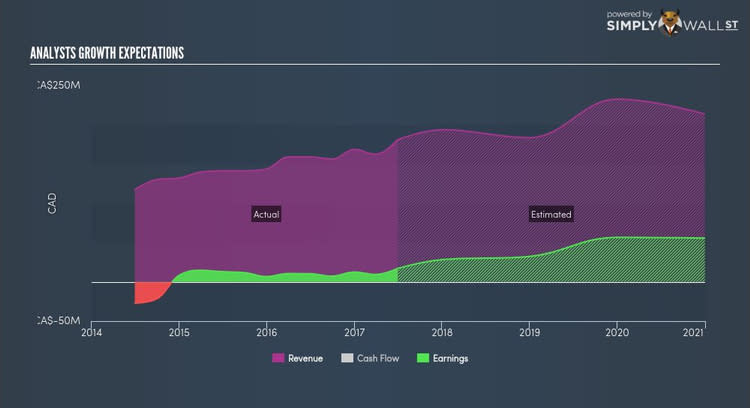

Richmont Mines Inc. (TSX:RIC)

Richmont Mines Inc. engages in the mining, exploration, and development of mining properties in Canada. Founded in 1981, and now run by Renaud Adams, the company provides employment to 491 people and has a market cap of CAD CA$706.46M, putting it in the small-cap group.

Extreme optimism for RIC, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by a double-digit sales growth of 14.79%. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of RIC, it does not appear extreme. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 12.92%. RIC ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? I recommend researching its fundamentals here.

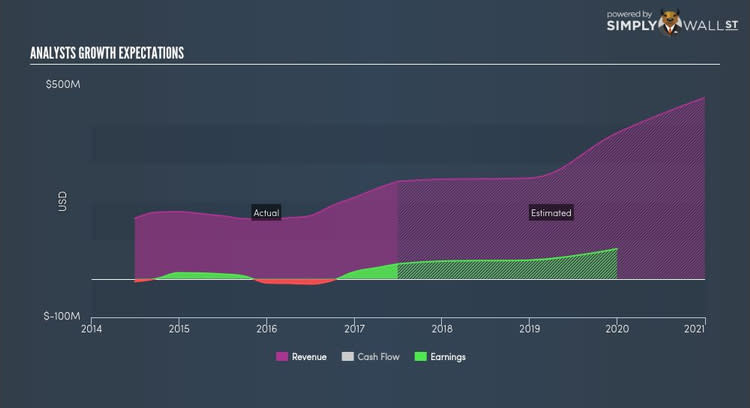

Fortuna Silver Mines Inc. (TSX:FVI)

Fortuna Silver Mines Inc. engages in the exploration, extraction, and processing of mineral properties in Latin America. Established in 1990, and run by CEO Jorge Durant, the company size now stands at 780 people and has a market cap of CAD CA$878.64M, putting it in the small-cap stocks category.

FVI’s projected future profit growth is an exceptional 62.84%, with an underlying 26.55% growth from its revenues expected over the upcoming years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 13.49%. FVI ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Check out its fundamental factors here.

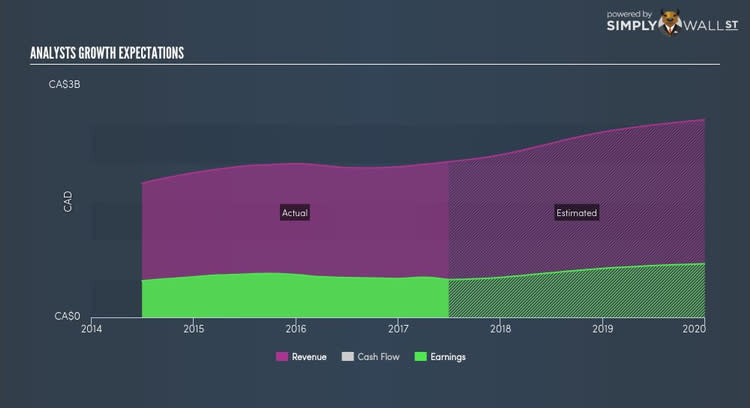

CI Financial Corp (TSX:CIX)

CI Financial Corp. is a publicly owned asset management holding company. Formed in 1965, and now led by CEO Peter Anderson, the company provides employment to 1,578 people and has a market cap of CAD CA$7.89B, putting it in the mid-cap group.

CIX is expected to deliver an extremely high earnings growth over the next couple of years of 36.10%, driven by a positive double-digit revenue growth of 22.96% and cost-cutting initiatives. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 30.84%. CIX’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Want to know more about CIX? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.