How Financially Strong Is NAHL Group plc (AIM:NAH)?

While small-cap stocks, such as NAHL Group plc (AIM:NAH) with its market cap of GBP £69.65M, are popular for their explosive growth, investors should also be aware of their balance sheet to judge whether the company can survive a downturn. The significance of doing due diligence on a company’s financial strength stems from the fact that over 20,000 companies go bankrupt in every quarter in the US alone. These factors make a basic understanding of a company’s financial position of utmost importance for a potential investor. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. View our latest analysis for NAHL Group

Does NAH generate an acceptable amount of cash through operations?

Unxpected adverse events, such as natural disasters and wars, can be a true test of a company’s capacity to meet its obligations. These adverse events bring devastation and yet does not absolve the company from its debt. Fortunately, we can test the company’s capacity to pay back its debtholders without summoning any catastrophes by looking at how much cash it generates from its current operations. Last year, NAH’s operating cash flow was 0.59x its current debt. This is a good sign, as over half of NAH’s near term debt can be covered by its day-to-day cash income, which reduces its riskiness to its debtholders.

Can NAH meet its short-term obligations with the cash in hand?

What about its other commitments such as payments to suppliers and salaries to its employees? In times of adverse events, NAH may need to liquidate its short-term assets to pay these immediate obligations. We should examine if the company’s cash and short-term investment levels match its current liabilities. Our analysis shows that NAH does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

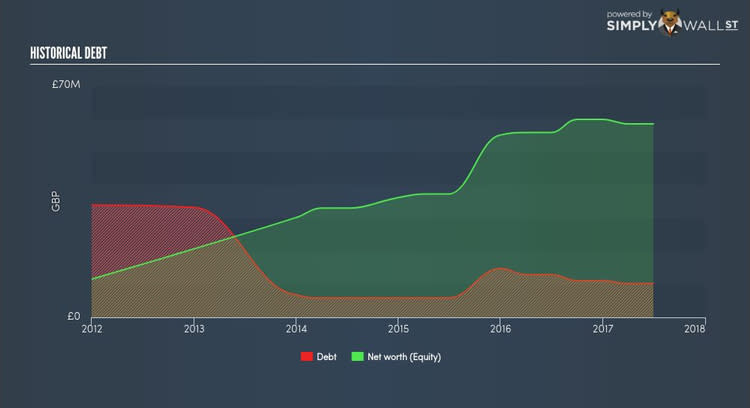

Is NAH’s level of debt at an acceptable level?

Debt-to-equity ratio tells us how much of the asset debtors could claim if the company went out of business. In the case of NAH, the debt-to-equity ratio is 17.53%, which means its risk of facing a debt-overhang is very low. We can test if NAH’s debt levels are sustainable by measuring interest payments against earnings of a company. Ideally, earnings should cover interest by at least three times, therefore reducing concerns when profit is highly volatile. NAH’s profits amply covers interest at 72.99 times, which is seen as relatively safe. Lenders may be less hesitant to lend out more funding as NAH’s high interest coverage is seen as responsible and safe practice.

Next Steps:

Are you a shareholder? NAH’s high cash coverage and conservative debt levels indicate its ability to utilise its borrowings efficiently in order to generate ample cash flow. But it is still important for shareholders to understand why the company isn’t increasing its cheaper cost of capital to fund future growth, especially when liquidity may also be an issue. You should take a look at NAH’s future growth analysis on our free platform. to examine the company’s position in further detail.

Are you a potential investor? Although NAH’s debt level is relatively low, it has the ability to efficiently utilise its borrowings to generate ample cash flow coverage. However, in the event of adversity, the company may struggle to meet its short-term obligations due to its low liquidity in assets. As a following step, you should take a look at NAH’s past performance analysis on our free platform to conclude on NAH’s financial health.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.