How Financially Strong Is Workday Inc (NASDAQ:WDAY)?

Large-cap companies such as Workday Inc (NASDAQ:WDAY), with a market-capitalization of $21.52B, are much sought after by risk-averse investors who find diversified revenue streams and strong capital returns more comforting than explosive growth potential. But another key factor to consider when investing in WDAY is its financial health. Why is it important? A major downturn in the energy industry has resulted in over 150 companies going bankrupt and has put more than 100 on the verge of a collapse, primarily due to excessive debt. These factors make a basic understanding of a company’s financial position of utmost importance for a new investor. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. Check out our latest analysis for Workday

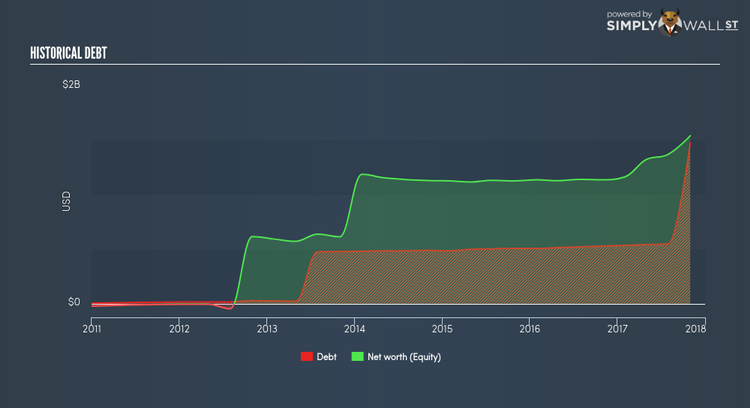

Is WDAY’s level of debt at an acceptable level?

A debt-to-equity ratio threshold varies depending on what industry the company operates, since some requires more debt financing than others. A ratio below 40% for large-cap stocks is considered as financially healthy, as a rule of thumb. In the case of WDAY, the debt-to-equity ratio is 95.66%, which means that it is a highly leveraged company. This is not a problem if the company has consistently grown its profits. But during a business downturn, as liquidity may dry up, making it hard to operate.

Does WDAY generate enough cash through operations?

A basic way to evaluate WDAY’s debt management is to see whether the cash flow generated from the business is at a relatively high level compared to the debt capital invested. This is also a test for whether WDAY has the ability to repay its debt with cash from its business, which is less of a concern for large companies. WDAY’s recent operating cash flow was 0.3 times its debt within the past year. This is a good sign, as over a quarter of WDAY’s near term debt can be covered by its day-to-day cash income, which reduces its riskiness to its debtholders.

Next Steps:

Are you a shareholder? WDAY’s high cash coverage means that, although its debt levels are high, investors shouldn’t panic since the company is able to utilise its borrowings efficiently in order to generate cash flow. Given that WDAY’s capital structure may change, I suggest assessing market expectations for WDAY’s future growth on our free analysis platform.

Are you a potential investor? Although understanding the serviceability of debt is important when evaluating which companies are viable investments, it shouldn’t be the deciding factor. After all, debt financing is an important source of funding for companies seeking to grow through new projects and investments. That’s why I suggest you assess WDAY’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.