Finding The Best Bets In An Uncertain Market

The first few weeks of May have revealed that uncertainty still holds sway over the broad market. Despite a solid earnings season that saw about 76 percent of companies exceeding analyst expectations, according to research from Factset, and the S&P 500 index marking its first new high since September 2018, diminished revenue outlook, continued strife in U.S.-China trade relations and the threat of slowing global growth have dampened equity market enthusiasm.

In order to negotiate uncertainty, traders could take recourse in portfolio strategies that emphasize stocks with strong characteristics across multiple factors, such as the Best Bets Q-Folio generated by the AI models from investment research platform, Quantamize. The Best Bets Q-Folio is a concentrated stock portfolio consisting of US-listed stocks rated as "Top Buys" according to their Quantamize Q-Factor scoring system.

Taking a look at the Best Bets Q-Folio’s characteristics, the model portfolio clearly emphasizes companies with strong historical and forward-looking performance.

Image courtesy of Quantamize

The Q-folio’s statistics show its preference for stocks that deliver strong return on equity, at 19.36 percent, while also maintaining a bias for stocks with a relatively high outlook, as shown by the model portfolio’s 17.37 multiple on forward price-to-earnings.

With that in mind, here are the portfolio’s top 10 holdings, rebalanced as of May 1.

Image courtesy of Quantamize

From the jump, the Q-Folio’s top holding, CSW Industrials Inc. (NASDAQ: CSWI), has shown strong annual growth from the past five years, particularly in increasing revenue between 2016 and 2018. CSWI’s latest annual balance sheet’s drop in income is the result of lost revenue from discontinued operations, which could allow for better allocation of the funds elsewhere in the company.

Image courtesy of Quantamize

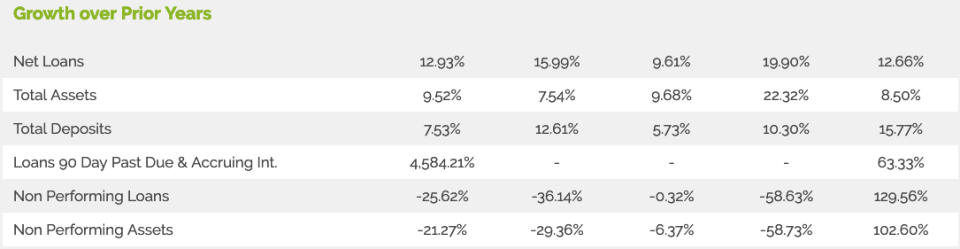

Also showing strong historical growth, Unity Bancorp, Inc. (NASDAQ: UNTY) has a proven track record of maintaining a consistent loan portfolio. At the same time, the regional bank also increased its debt assets over the course of 2018, which, in conjunction with annual revenue growth of about 15 percent, illustrates how Unity has positioned itself for a strong 2019.

Image courtesy of Quantamize

Finally, one of the best-performing stocks in the Q-Folio’s top holdings is CSG Systems International, Inc. (NASDAQ: CSGS), which is up 42 percent year-to-date as of this writing. Part of this increase is due to a blowout fourth-quarter earnings report which saw the company beat bottom line expectations by 23 percent. This news caused the stock to briefly spike into overbought territory. However, CSGS has receded in the intervening months into an attractive range following another solid quarterly earnings report delivered at the start of May.

Image courtesy of Quantamize

Although there are no guarantees in the world of equity investments, there are key characteristics and signals investors can rely on to beat uncertainty. While leveraging these factors on your own can help shore up an investment strategy, it helps when cutting edge multi-factor technology can do the heavy lifting.

Quantamize is a content partner of Benzinga.

See more from Benzinga

New White Paper Delves Into The Profile Of Direxion's Relative Weight ETFs

Headline Edge: Is The Surge In Oil Price Revving Up or Running On Empty?

C&I Loans Surged Late 2018, But That's Set To Change In 2019

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.