FinVolution Group's (NYSE:FINV) Sentiment Matching Earnings

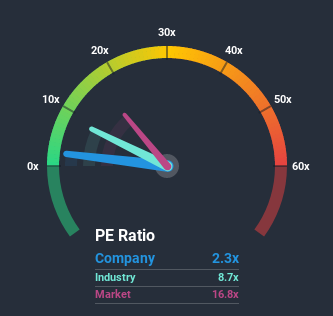

With a price-to-earnings (or "P/E") ratio of 2.3x FinVolution Group (NYSE:FINV) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 34x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, FinVolution Group's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for FinVolution Group

Where Does FinVolution Group's P/E Sit Within Its Industry?

An inspection of average P/E's throughout FinVolution Group's industry may help to explain its particularly low P/E ratio. You'll notice in the figure below that P/E ratios in the Consumer Finance industry are also lower than the market. So we'd say there could be some merit in the premise that the company's ratio being shaped by its industry at this time. Ordinarily, the majority of companies' P/E's would be compressed by the general conditions within the Consumer Finance industry. We'd highlight though, the spotlight should be on the anticipated direction of the company's earnings.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on FinVolution Group.

How Is FinVolution Group's Growth Trending?

In order to justify its P/E ratio, FinVolution Group would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 25%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 6.0% per year during the coming three years according to the three analysts following the company. With the market predicted to deliver 10.0% growth each year, that's a disappointing outcome.

With this information, we are not surprised that FinVolution Group is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From FinVolution Group's P/E?

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of FinVolution Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with FinVolution Group (at least 2 which can't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of FinVolution Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.