First Midwest Bancorp's (NASDAQ:FMBI) Dividend Will Be US$0.14

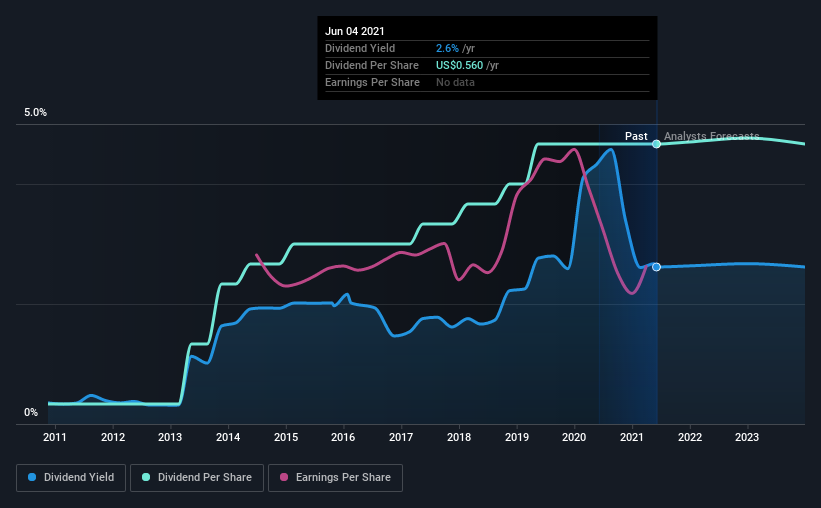

The board of First Midwest Bancorp, Inc. (NASDAQ:FMBI) has announced that it will pay a dividend on the 13th of July, with investors receiving US$0.14 per share. This makes the dividend yield 2.6%, which will augment investor returns quite nicely.

View our latest analysis for First Midwest Bancorp

First Midwest Bancorp's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, First Midwest Bancorp was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 41.3%. If the dividend continues on this path, the payout ratio could be 42% by next year, which we think can be pretty sustainable going forward.

First Midwest Bancorp Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2011, the dividend has gone from US$0.04 to US$0.56. This implies that the company grew its distributions at a yearly rate of about 30% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

First Midwest Bancorp May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. First Midwest Bancorp hasn't seen much change in its earnings per share over the last five years. The company has been growing at a pretty soft 0.5% per annum, and is paying out quite a lot of its earnings to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

First Midwest Bancorp Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for First Midwest Bancorp that investors should know about before committing capital to this stock. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.