'Fiscal Cliff' Notes On Using VIX ETPs

VIX-based exchange-traded products look attractive as a short-term play on the “fiscal cliff,” but use caution when picking up one of these power tools.

The level of the CBOE Volatility Index, known as the VIX, crossed 20 during the Dec. 27 trading session for the first time since July—an important threshold for investor concern as noted in the Wall Street Journal. For an index known as the “fear gauge,” the VIX has largely slept through all the fretting over the fiscal cliff, but it does finally seem to be stirring.

Before we touch on why VIX ETPs may be attractive now, let’s take a quick look at how they work.

The VIX index is a market-based forward estimate of equity risk. It measures implied volatility on the S'P 500 using an options-pricing model. Specifically, it looks at the market prices of puts and calls on the S'P 500 as an input, and backs out the volatility that’s “implied” or embedded in the options price.

As such, the VIX seems tailor-made to provide investors with short-term upside from potential blunt-force trauma to markets—like the fiscal cliff.

In general, the VIX moves counter to the S'P 500, reinforcing its appeal as a potential hedge to equity market nose dives. Here’s a snapshot of VIX levels and S'P 500 index levels YTD.

But the VIX index itself is not investable, so VIX-based ETFs and ETNs rely on futures on the VIX for exposure as the next best thing.

This reliance on futures for exposure leads to a host of challenges, but maybe an opportunity too.

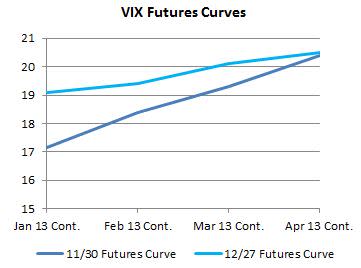

The VIX futures curve is typically in contango, meaning far-dated futures have higher prices than near-dated futures.

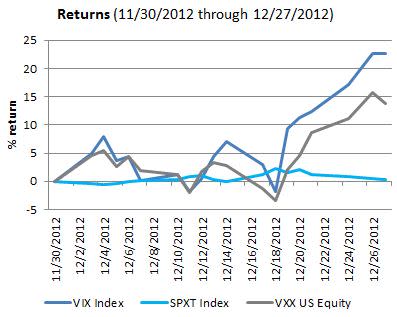

This condition eats away at long-term returns for futures-based products, as shown in this snapshot comparing returns for the S'P (light blue), the VIX index (dark blue) and the iPath S'P 500 VIX Short-Term Futures ETN VXX (VXX) (gray), the most popular VIX ETP.

This graph emphatically demonstrates that VIX ETPs on their own aren’t designed for long-term exposure, with VXX down close to 80 percent. In fact, VIX ETPs are right at the top of the list of some of the worst performers of 2012.

But investors likely use VIX ETPs, first and foremost, as short-term products. Folloiwing is a look over a shorter time period—Nov. 30 through Dec. 27.

This makes a more compelling case. The uninvestable VIX has taken off in December and the “next best thing,” VXX, has too, if not by the same amount.

More to the point, if market participants finally start to fear the fiscal cliff, the VIX could shoot up much higher in the short run, with VXX in its wake.

I mentioned an opportunity above related to VIX futures exposure. The VIX futures curve has flattened lately and at times even tilted toward backwardation on an intraday basis.

Here’s a snapshot of the curve at two points in time—Nov. 30 in dark blue and Dec. 27 in light blue.

While the shape of the curve can be volatile, a flatter future curve means that returns are impacted less by decay or negative roll yield. And backwardation, if it occurs, will help returns, especially for front-month products like VXX.

So if the looming fiscal cliff has your internal fear gauge flashing red like John Boehner’s baseball cap, VIX-based ETPs provide one way to take action. But as ever, handle these power tools with great care.

At the time this article was written, the author had no positions in the securities mentioned. Contact Paul Britt at pbritt@indexuniverse.com . All data from Bloomberg.

Permalink | ' Copyright 2012 IndexUniverse LLC. All rights reserved