Fiserv (FISV) Banks on Acquisitions, Debt Woes Continue

Fiserv, Inc. FISV is currently benefiting from its size and scale of operations, cost reduction efforts and strategic acquisitions.

Fiserv recently reported second-quarter 2021 adjusted earnings per share of $1.37 that beat the Zacks Consensus Estimate by 6.2% and increased 47.3% year over year. Adjusted revenues of $3.86 billion surpassed the consensus estimate by 3.8%.

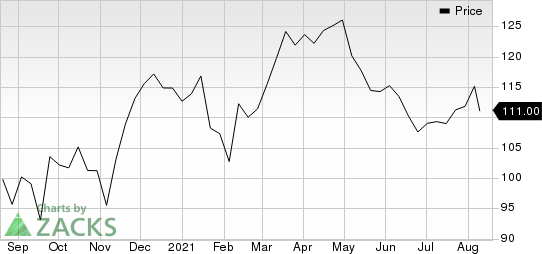

The company’s shares have gained 13.8% over the past year against 3.3% decline of the industry it belongs.

Fiserv, Inc. Price

Fiserv, Inc. price | Fiserv, Inc. Quote

How is Fiserv Doing?

Fiserv continues to focus on improving its product and service quality through leveraging its size and scale of operations, reducing costs and effectively integrating First Data operations. The company is streamlining its overall cost structure through rationalization of duplicate costs in order to attain planned cost synergies.

Fiserv is expanding its product portfolio through strategic acquisitions. The recent acquisition of Pineapple Payments has placed Fiserv in a position to expand the reach of its payments solutions, especially Clover and Clover Connect. Another recent acquisition, Ondot Systems, is expected to enhance its digital capabilities, thus strengthening its competitive position. In 2020, the company acquired MerchantPro Express, Bypass Mobile and Inlet. While MerchantPro expands its merchant services business, Bypass enhances its omni-commerce capabilities and Inlet boosts its digital bill payment strategy.

Fiserv’s cash and cash equivalent of $841 million at the end of second-quarter 2021 was well below the long-term debt level of $20.4 billion. This indicates that the company doesn’t have enough cash to meet this debt burden. However, the cash level can meet the short-term debt of $418 million.

Zacks Rank and Other Stocks to Consider

Fiserv currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other similarly ranked stocks in the broader Zacks Business Services sector are ManpowerGroup MAN, Equifax EFX and TransUnion TRU, each carrying a Zacks Rank #2 (Buy) as well.

The long-term expected earnings per share (three to five years) growth rate for ManpowerGroup, Equifax and TransUnion is 23.1%, 15.2% and 22%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research