Fiserv (FISV) Q3 Earnings, Revenues Lag Estimates, Stock Down

Fiserv, Inc. FISV reported disappointing third-quarter 2018 results wherein both earnings and revenues lagged the Zacks Consensus Estimate. In response to the lower-than-expected results, shares declined 2.9% in after-hours trading yesterday.

Adjusted earnings per share (EPS) of 75 cents missed the consensus mark by 2 cents but rose on a year-over-year basis attributable to operating leverage, tax rate reductions and capital deployment.

Revenues of $1.41 billion lagged the consensus estimate by $19.4 million but came ahead of the year-ago figure by $12 million. Adjusted revenues of $1.35 billion increased $10 million on a year-over-year basis. The improvement in revenues was driven by strong results from a number of businesses, including Card, Biller, and Bank Solutions.

Concurrent with the earnings release, Fiserv announced completion of acquisition of the debit-based assets of Elan Financial Services, a unit of U.S. Bancorp (USB), for approximately $690 million. The deal includes the purchase of Elan’s debit card processing, ATM Managed Services and MoneyPass surcharge free network. It should boost Fiserv’s payments portfolio, widen its client base and provide new solutions to enhance the value proposition for its existing 3,000 debit solutions clients.

So far this year, shares of Fiserv have gained 21%, significantly outperforming the 10.8% rally of the industry it belongs to and 0.4% rise of the Zacks S&P 500 composite.

Let’s check out the numbers in detail.

Revenues in Detail

Revenues at the Payments and Industry Products segment increased 6% year over year to $844 million. The upside was driven by card services and biller businesses’ solid performance and increased adoption and growing transaction volumes. In the quarter, debit transactions grew double digits, total P2P transactions, including both Popmoney and Zelle, grew nearly 50% and Mobiliti ASP subscribers increased 23% to nearly 8 million, all contributing significantly to growth in digital and payments solutions.

Revenues at the Financial Institution Services segment decreased 7.3% year over year to $574 million. These revenues were hurt by the divestiture of 55% interest of the company's Lending Solutions business (the "Lending Transaction").

Internal revenue growth was 5% in the reported quarter, with 5% growth in the Payments segment and 4% growth in the Financial segment.

Revenues at the Total processing and Services segment increased 2% on a year-over-year basis to $1.22 billion, while product revenues were down 5.9% year over year to $189 million.

Operating Results

Adjusted operating income of $425 million was down 2.3% from the year-ago quarter. Adjusted operating margin declined 100 basis points (bps) year over year to 31.6%. The decline was due to a negative impact of 160 bps resulting from Lending divestiture, acquisitions completed last year and the impact of client-focused incremental investments funded through tax savings. These were, however, partially offset by a positive impact of 60 bps from the company’s strong operational effectiveness performance and operating model leverage.

Adjusted operating income at the Payments and Industry Products segment was $267 million, up 5.1% year over year. However, adjusted operating margin contracted 40 bps to 34.2%. Segmental adjusted operating margin was hurt by a negative impact of 140 bps owing to acquisitions and investments from tax savings.

Operating income at the Financial Institution Services segment totaled $204 million, down 8.3% year over year due to the Lending transaction. Operating margin declined 40 bps to 32.7%.

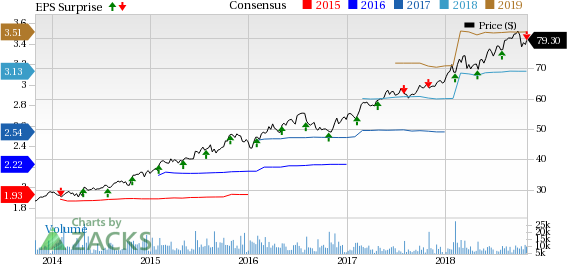

Fiserv, Inc. Price, Consensus and EPS Surprise

Fiserv, Inc. Price, Consensus and EPS Surprise | Fiserv, Inc. Quote

Balance Sheet and Cash Flow

Fiserv exited third-quarter 2018 with cash and cash equivalents of $673 million compared with $348 million at the end of the prior quarter. Long-term debt at the end of the quarter was $4.82 billion compared with $4.81 billion at the end of the prior quarter.

The company generated $368 million of net cash from operating activities in the reported quarter. Free cash flow was $322 million. Capital expenditures were $94 million.

During the reported quarter, Fiserv repurchased 5.6 million shares for $438 million and announced a new 30 million share repurchase authorization. As of Sep 30, 2018, the company had 34.9 million shares available for buyback.

2018 Outlook

Fiserv raised the lower end of adjusted EPS guidance for 2018.Adjusted earnings per share are expected in the range of $3.10-$3.15, which indicates 25-27% year-over-year growth after adjusting for the Lending Transaction. The previously guided range was $3.02-$3.15 per share. The Zacks Consensus Estimate of $3.13 is almost in line with the midpoint of the currently guided range.

Fiserv continues to expect internal revenue growth of at least 4.5%. Additionally, the company anticipates adjusted operating margin to be around 10 bps and free cash flow conversion to be around 106%for 2018. Full year adjusted effective tax rate is expected to be below 22%.

Zacks Rank & Upcoming Releases

Fiserv currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the broader Business Services sector are keenly awaiting third-quarter earnings reports from key players like Genpact G, Delphi Technologies DLPH and Green Dot GDOT. While Genpact will report on Nov 6, Delphi Technologies and Green Dot will release quarterly results on Nov 7.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delphi Technologies PLC (DLPH) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research