Five Below Comps Performance Decent, Digital Efforts in Place

Five Below, Inc.’s FIVE impressive merchandise assortment, focus on pre-teen customers, enhancement of digital and e-commerce channels, and pricing strategy aids the company stand tall amid a tough retail landscape. These along with healthy performance of new outlets and decent comparable sales run are likely to propel the top line.

The aforementioned factors may be cited as reasons behind the company’s bullish run on the bourses. Notably, shares of this Zacks Rank #2 (Buy) stock has surged roughly 27% in the past three months, outperforming the industry’s growth of 13%.

Let’s Analyze

Management’s primary focus on teens and pre-teens, helps the company enhance customer base by attracting shoppers. The company is known for its impressive range of merchandise, as it remains committed toward making innovations and refreshing its product range per the evolving consumer trends. These factors combined with the company’s pricing strategy of selling products for $5 or below enable it to cater to demographic shoppers.

We believe that Five Below’s wide assortment of trend right merchandise, solid in-store and online experience along with favorable pricing strategy are likely to remain major growth drivers. Further, the company remains focused on achieving efficient cost structure, solid average net sales per store, supply-chain initiatives and economies of scale.

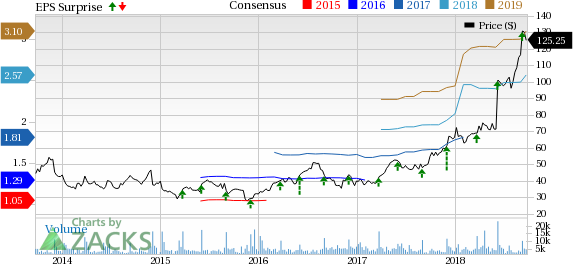

Five Below, Inc. Price, Consensus and EPS Surprise

Five Below, Inc. Price, Consensus and EPS Surprise | Five Below, Inc. Quote

These endeavors have helped Five Below to score decent comparable sales growth. Comparable sales increased 3.2% and 2.7% in the first and second quarter of fiscal 2018 quarter. The company now anticipates comparable sales to increase in the band of 2.5-3% during fiscal 2018 and between 3-4% in the third quarter. The company’s solid store remodeling is a major reason behind its healthy comparable sales performance.

The company remains committed toward expanding its store base, as well as enhancing the in-store experience to draw traffic and enhance customer base. Incidentally, Five Below opened 103 new stores during fiscal 2017. The company plans to open 125 new stores during fiscal 2018 with 50 outlets expected to be opened in the third quarter. Further, the company envisions of having a network of more than 2,500 stores in the long run.

Wrapping Up

Five Below’s strategic initiatives remain well on track and are likely to help attain the set target for fiscal 2018. The company envisions net sales in the range of $1.528-$1.540 billion, reflecting an increase of 21-22% year over year. Management expects earnings between $2.51 and $2.57 per share for the fiscal year.

Given the company’s upbeat outlook, analysts covering the stock have been tweaking their estimates to better align with the company’s projection. Consequently, the Zacks Consensus Estimate have been witnessing an uptrend. The consensus mark for fiscal 2018 and 2019 has increased by 9 cents and 10 cents to $2.57 and $3.10, respectively, in the past 30 days. The Zacks Consensus Estimate for the third quarter has risen by a couple of cents to 19 cents in the said period.

3 More Retails Stocks to Bank Upon

Here are three more retail stocks you can consider apart from Five Below.

Zumiez ZUMZ delivered an average positive earnings surprise of 9.6% in the trailing four quarters. It flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Boot Barn Holdings BOOT delivered an average positive earnings surprise of 31.8% in the trailing four quarters. It has a long-term earnings growth rate of 23% and a Zacks Rank #1.

Urban Outfitters URBN delivered an average positive earnings surprise of 17.7% in the trailing four quarters. It has a long-term earnings growth rate of 12% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research