FLEETCOR (FLT) Q4 Earnings & Revenues Beat Mark, Rise Y/Y

FLEETCOR Technologies, Inc.FLT reported solid fourth-quarter 2021 results as both earnings and revenues surpassed the Zacks Consensus Estimate.

Adjusted earnings of $3.72 per share outpaced the consensus estimate by 3.3% and increased 24% year over year. Revenues of $802.3 million beat the consensus mark by 4.7% and increased 30% year over year on a reported basis and 17% on a pro-forma and macro-adjusted basis.

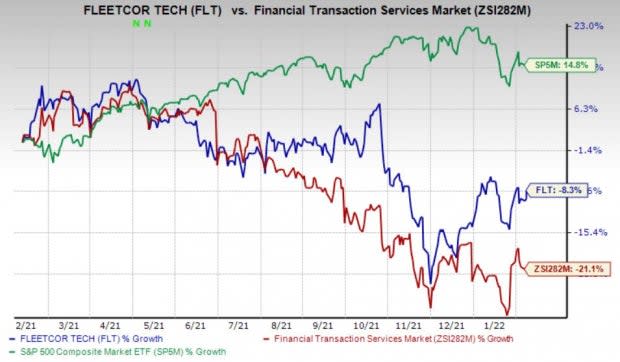

Over the past year, shares of FLEETCOR have declined 8.3% compared with 21.1% loss of the industry it belongs to. The Zacks S&P 500 composite grew 14.8% in the same time frame.

Image Source: Zacks Investment Research

Let’s check out the numbers in detail:

Revenues in Detail

Segment wise, revenues from North America came in at $554.91 million, up 36.8% year over year. Internationally, revenues of $141.75 million increased 16.9% year over year. Revenues from Brazil grew 16.7% to $105.59 million.

Product-category wise, fuel revenues of $316.4 million went up 22% year over year on a reported basis and 12% on a pro-forma and macro-adjusted basis.

Corporate Payments revenues of $174.5 million increased 52% year over year on a reported basis and 18% on a pro-forma and macro-adjusted basis.

Tolls revenues of $86.7 million improved 13% year over year on a reported basis and 17% on a pro-forma and macro-adjusted basis.

Lodging revenues of $103.1 million grew 82% year over year on a reported basis and 39% on a pro-forma and macro-adjusted basis.

Gift revenues of $55.1 million grew 19% year over year on a reported as well as on a pro-forma and macro-adjusted basis.

Other revenues of $66.4 million increased 6% year over year on a reported as well as on a pro-forma and macro-adjusted basis.

Operating Results

Operating income increased 15.8% from the prior-year quarter’s level to $340.29 million. Operating income margin came in at 42.4% from 47.6% in the prior-year quarter.

FleetCor Technologies, Inc. Price, Consensus and EPS Surprise

FleetCor Technologies, Inc. price-consensus-eps-surprise-chart | FleetCor Technologies, Inc. Quote

Balance Sheet & Cash Flow

FLEETCOR exited fourth-quarter 2021 with cash, cash equivalents and restricted cash of $2.25 billion compared with $2.01 billion at the end of the prior quarter.

The company generated $595.72 million of net cash from operating activities. Capital expenditures totaled $37.08 million.

In the reported quarter, FLEETCOR repurchased shares worth $533.45 million.

First-Quarter 2022 Guidance

For first-quarter 2022, FLEETCOR expects revenues between $740 million and $760 million. The Zacks Consensus Estimate of $752.24 million lies below the guidance.

Adjusted earnings per share are anticipated between $3.45 and $3.55. The Zacks Consensus Estimate of $3.61 lies above the guidance.

2022 Guidance

FLEETCOR has unveiled its guidance for 2022. Adjusted earnings per share are anticipated between $15 and $15.50. The Zacks Consensus Estimate of $15.28 lies within the guidance.

Revenues are anticipated in the range of $3.19-$3.25 billion. The Zacks Consensus Estimate of $3.18 billion lies below the guidance.

Adjusted tax rate is anticipated between 24% and 26%. Interest expenses are expected between $90 million and $100 million.

Currently, FLEETCOR carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Robert Half International RHI delivered impressive fourth-quarter 2021 results, with earnings and revenues beating the Zacks Consensus Estimate.

Robert Half’s quarterly earnings of $1.51 per share beat the consensus mark by 5.6% and rose 79.8% year over year.

Robert Half’s revenues of $1.77 billion surpassed the consensus mark by 4.3% and increased 36.2% year over year on a reported basis and 36% on an as-adjusted basis.

Automatic Data ProcessingADP reported better-than-expected second-quarter fiscal 2022 results.

ADP’s adjusted earnings per share of $1.65 beat the Zacks Consensus Estimate by 1.2% and rose 9% year over year.

ADP’s total revenues of $4.03 billion beat the consensus mark by 1.1% and improved 9% year over year on a reported basis as well as on an organic constant-currency basis.

Rollins ROL reported mixed fourth-quarter 2021 results, with earnings meeting the Zacks Consensus Estimate and revenues beating the same.

Rollins’ adjusted earnings of 14 cents per share meet the Zacks Consensus Estimate and increased 7.7% year over year.

Rollins’ revenues of $600.3 million beat the consensus mark by 3.3% and improved 11.9% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

To read this article on Zacks.com click here.