The Flex LNG (OB:FLNG) Share Price Is Down 59% So Some Shareholders Are Wishing They Sold

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for Flex LNG Ltd. (OB:FLNG) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 59% in that time. Flex LNG hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 26% in the last three months.

See our latest analysis for Flex LNG

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Flex LNG share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Flex LNG's dividend seems healthy to us, so we doubt that the yield is a concern for the market. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Unless, of course, the market was expecting a revenue uptick.

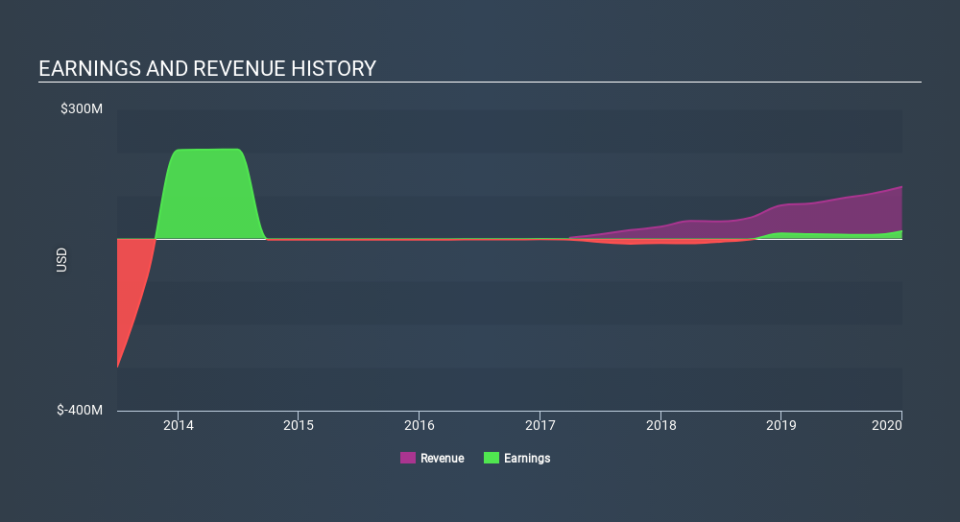

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We doubt Flex LNG shareholders are happy with the loss of 57% over twelve months (even including dividends) . That falls short of the market, which lost 9.1%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 26%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Flex LNG better, we need to consider many other factors. For instance, we've identified 4 warning signs for Flex LNG (2 are concerning) that you should be aware of.

Flex LNG is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.