Flowers Foods (FLO) on Track to Boost Shareholder Returns

Flowers Foods, Inc. FLO is committed to rewarding shareholders through dividend payments and share buyback activities. For this purpose, the well-known producer of packaged bakery foods announced a dividend hike. In addition, the company increased its share repurchase authorization.

Let’s take a closer look.

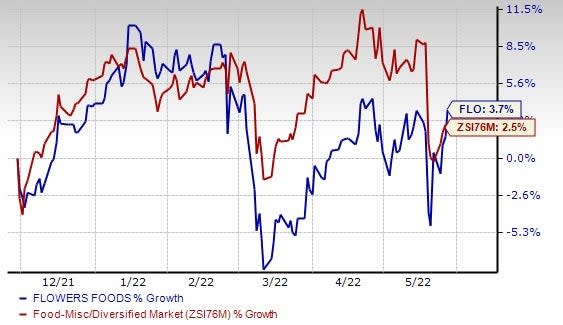

Image Source: Zacks Investment Research

Boosting Shareholder Returns

Flowers Foods will now pay a quarterly dividend of 22 cents per share, up 4.8% from the year-ago period’s rate. The hiked dividend will be paid out on Jun 23, 2022, to shareholders of record as of Jun 9. This will mark the company’s 79th consecutive quarterly dividend paid.

The dividend hike now takes up the annualized dividend rate to 88 cents per share compared with 84 cents per share paid during the previous year. Flowers Foods currently has a dividend payout of 67%, a dividend yield of 3.1% and a free cash flow yield of 2.6%. With an annual free cash flow return on investment of 6.4%, the increased dividend is likely to be sustainable. During the first quarter of fiscal 2022, FLO paid out dividends worth $46.7 million.

Along with the dividend hike, the company increased its share repurchase authorization by 20 million shares. The move takes the current authorization to 25.4 million shares. The increased repurchase authorization gives Flowers Foods sufficient repurchase capacity as it continues to implement its growth plans and preserve balance sheet discipline. We note that Flowers Foods had 5.4 million shares outstanding under its existing authorization at the end of the fiscal first quarter.

The aforementioned moves speak volumes about Flowers Foods’ growth prospects and balance sheet strength. FLO’s shares have increased 3.7% in the past six months compared with the industry’s 2.5% growth.

What Else Should You Know?

The Zacks Rank #4 (Sell) company has been seeing elevated costs for a while. During the recently released first-quarter fiscal 2022 results, the company’s materials, supplies, labor and other production costs (excluding depreciation and amortization) escalated by 110 basis points (bps) to 50.5%. This was a result of increased ingredient and packaging expenses. The company’s adjusted EBITDA margin was 11.5%, which contracted 90 bps in the quarter. Apart from this, Flowers Foods’ selling, distribution and administrative (SD&A) expenses came in at 38.6% of sales, up 10 bps, thanks to escalated consulting costs and transportation cost inflation.

Management adjusted its fiscal 2022 outlook to reflect higher pricing, more-than-anticipated inflation and supply chain disruptions. For fiscal 2022, adjusted earnings per share (EPS) are envisioned in the range of $1.20-$1.30. Management earlier expected adjusted EPS between $1.25 and $1.35. The company has undertaken price increases to counter shortages and dynamic commodity prices. Management expects the pricing action to come into effect during the fiscal second quarter. Incidentally, the price lag and supply chain disruptions are likely to hurt EPS by 5 cents in the fiscal second and third quarter.

3 Solid Food Stocks

Some better-ranked stocks are Pilgrim’s Pride PPC, Sysco Corporation SYY and Medifast MED.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen and value-added chicken and pork products, sports a Zacks Rank #1(Strong Buy). PPC has a trailing four-quarter earnings surprise of 31.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pilgrim’s Pride’s current financial year EPS suggests growth of almost 43% from the year-ago reported number.

Sysco, which engages in the marketing and distributing of various food and related products, carries a Zacks Rank #2 (Buy). SYY has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for Sysco’s current financial year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago reported number.

Medifast, which manufactures and distributes weight loss, weight management, healthy living products and other consumable health and nutritional products, currently carries a Zacks Rank #2. MED has a trailing four-quarter earnings surprise of 12.9%, on average.

The Zacks Consensus Estimate for Medifast’s current financial year sales and EPS suggests growth of almost 19% and 11.5%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sysco Corporation (SYY) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research