Flowers Foods (FLO) Well-Poised on Pricing & Core Priorities

Flowers Foods, Inc. FLO looks well-placed, thanks to the company’s focus on strategic priorities and efficient pricing amid rising cost challenges. The company is also benefiting from its prudent acquisitions and effective innovation. On its last earnings call, management raised the lower end of its sales guidance for fiscal 2022.

Let’s delve deeper.

Key Upsides

Flowers Foods has been on track with its core priorities, which include developing its team, concentrating on brands, prioritizing margins and looking out for prudent mergers and acquisitions. To this end, management has been shifting focus toward building a more brand-focused company. The company expects its optimized portfolio to drive market share gains through innovation. The company is focused on undertaking innovation in its leading brands, which is likely to aid growth.

The company’s brand-building efforts, such as shifting a larger proportion of the sales mix to branded retail, are aiding performance. It is also undertaking saving measures and efforts to enhance business efficiency. Management expects savings of $20-$30 million from operational efficiencies and procurement in 2022. Apart from this, the company’s digital transformation initiative is an important driver of improved data and efficiencies. Finally, management intends to remain committed to undertaking smart M&A activities, which are in line with its portfolio strategy.

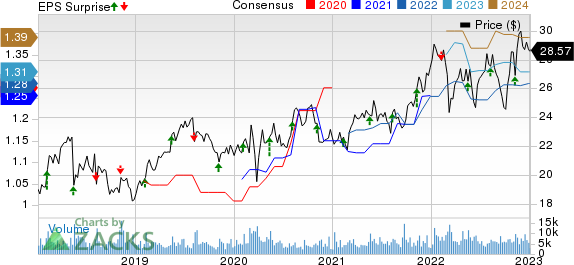

Flowers Foods, Inc. Price, Consensus and EPS Surprise

Flowers Foods, Inc. price-consensus-eps-surprise-chart | Flowers Foods, Inc. Quote

Flowers Foods has been benefiting from its pricing efforts for a while now. In the third quarter of fiscal 2022, the company’s favorable pricing efforts boosted sales in all channels. Impressive pricing and portfolio strategies, along with enhanced efficiencies, have been helping the company mitigate various inflationary and supply-chain pressures to generate better margins. The company has been particularly benefiting from price increases, undertaken in June 2022, to combat inflationary pressure.

Flowers Foods has been focusing on acquisitions to strengthen its product portfolio and expand in untapped markets. In December 2022, the company unveiled a deal to buy Papa Pita Bakery, which is anticipated to conclude in the first quarter of 2023. Additionally, acquired brands like Dave’s Killer Bread and Canyon Bakehouse continue to perform well. In the third quarter of 2022, Dave’s Killer Bread and Canyon Bakehouse saw tracked channel sales increases of 11.1% and 18.5%, respectively.

Cost Woes to be Offset?

Flowers Foods is battling major hurdles due to cost inflation and supply-chain bottlenecks. In the third quarter of fiscal 2022, materials, supplies, labor and other production costs (excluding depreciation and amortization) escalated by 310 basis points (bps) to 53.2%. This resulted from input cost inflation, partly mitigated by inflation-induced pricing. This was due to increased ingredient and packaging expenses, which led the gross margin to contract 310 bps to 46.8%. Increased cost inflation remains a concern for the company, though its pricing actions should offer respite.

A Look at Q3 & Ahead

Flowers Foods’ third-quarter fiscal 2022 sales advanced 12.7% year over year to $1,158.2 million, beating the Zacks Consensus Estimate of $1,144 million and our estimate of $1,142 million. Store-branded retail sales surged 31.5% to $163.9 million. Non-retail and other sales jumped 14.8% to $245.8 million.

Management remains focused on sustaining its solid momentum via increased innovation and marketing. The company’s launch of Dave's Killer Bread snack bars in 2023 will likely mark a step on the innovation path. Management raised the lower end of its sales guidance for fiscal 2022. For fiscal 2022, the company now expects sales in the range of $4.807-$4.850 billion, suggesting a rise of 11-12% year over year. Earlier, the company projected sales in the band of $4.764-$4.850 billion, indicating an increase of around 10-12% year over year.

Shares of this Zacks Rank #3 (Hold) company have rallied almost 16% in the past three months, compared with the industry’s growth of 12.2%.

3 Food Stocks to Grab

Some better-ranked stocks are Campbell Soup CPB, Ingredion Incorporated INGR and Nomad Foods NOMD.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank of 2 (Buy). CPB has a trailing four-quarter earnings surprise of 8.7%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Campbell Soup’s current financial-year sales and earnings suggests growth of 8.3% and 4.6%, respectively, from the corresponding year-ago reported figures.

Ingredion, which produces and sells starches and sweeteners, currently carries a Zacks Rank #2. Ingredion’s shares have surged 21.5% in the past three months.

The Zacks Consensus Estimate for INGR’s current financial-year earnings per share suggests an increase of 5.9% from the year-ago reported number.

Nomad Foods, a frozen food products company, currently carries a Zacks Rank #2. NOMD has a trailing four-quarter earnings surprise of 11.5%, on average.

Nomad Foods’ shares have increased almost 27% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report