Is Fluor a Buy?

Investors buy a stock for many reasons, and if you could put a group of its shareholders in a room, there's likely to be no end to the discussion as to why each individual investor bought the stock. Such a consideration springs to mind when thinking about prospects in 2019 for engineering and construction company Fluor Corporation (NYSE: FLR). Is the stock a turnaround story? A cyclical play on a long-term recovery in heavy-industries capital spending? A stock to be avoided on fears of a global slowdown? Let's look at the case for and against the stock.

The case for buying Fluor stock

There are two key arguments in favor of the stock.

The first sees Fluor, and other companies such as Caterpillar (NYSE: CAT), as being in the very early innings of a multiyear recovery in capital spending in heavy industries such as energy, chemicals, mining, and infrastructure. It's a viewpoint that sees the slowdown in 2015-2017 as creating stored-up demand that will be met over time. Throw in the possibility of an infrastructure spending bill, and Fluor has plenty of upside potential.

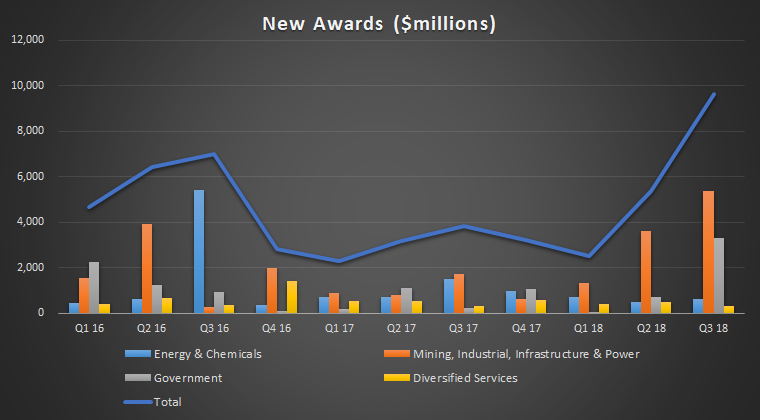

In support of these points, you can see in the chart below that Fluor has been winning new awards this year -- notably in its mining, industrial, infrastructure & power segment.

Data source: Fluor Corporation presentations.

Consequently, Fluor's backlog is rising again, and this bodes well for the company in 2019.

Data source: Fluor Corporation presentations. Chart by author.

The second argument highlights the fact that Fluor's stock has been sold off partly as a consequence of underperforming with contract execution in 2018 rather than purely due to its end markets. Issues relating to a downstream project in Europe and a gas-fired power plant in Florida led to the company's full-year EPS guidance being slashed from a range of $3.10 to $4.50 at the start of the year to $1.80 to $1.90 by the time of the third-quarter earnings.

The idea is that Fluor's stock has been overly discounted due to execution issues that the company can put behind it in 2019. Indeed, analysts are expecting the company's EPS to recover to $3.08 in 2019 from $1.85 in 2018. This is a forward estimate that makes the stock look cheap on a historical basis.

FLR PE Ratio (Forward) data by YCharts.

The case against Fluor stock

Putting these arguments together, Fluor is a turnaround story wrapped up in a cyclical growth play. That's all well and good if you are confident in Fluor's management and are looking for a way to play a recovery in energy and mining spending. But there are enough question marks around Fluor's 2019 to render the stock avoidable for most investors.

For a start, there's no guarantee that Fluor's end markets will continue to turn up in 2019 and beyond. And then you have to consider whether it makes sense to pin your hopes on the theme by investing in a company whose management disappointed in 2018.

As you can see in the chart below, energy and mining commodity prices sold off aggressively in the second half of 2018. And the debate now centers around whether the recent pause in mining capital spending is going to presage "slower but longer growth" as Caterpillar's management sees it, or whether it's the start of a protracted period of weakness.

WTI Crude Oil Spot Price data by YCharts.

Fluor CEO David Seaton seems to share Caterpillar's viewpoint. For example, on the last earnings call, he argued that: "I think there's a longer tail on this cycle for both mining and oil and gas. So I'm pretty bullish about mining over the longer term." However, his outlook on the industry is likely to be challenged if energy and mining commodity prices weaken.

Image source: Getty Images.

Is Fluor stock a buy?

As attractive as the risk/reward proposition is with Fluor, I can't help thinking that there are better ways to play the investing themes discussed here -- for example, with Caterpillar. Meanwhile, there's nothing stopping investors from simply buying into the commodities theme via an ETF or other means.

In a nutshell, Fluor needs a couple of quarters of solid execution, a backdrop of improving commodities prices, and evidence that the temporary pause in mining capital spending really is just part of a longer-term upward cycle. Only after these things have come together can investors feel more confident in buying the stock.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.