FMC Corp (FMC) Hits 52-Week High: What's Driving the Stock?

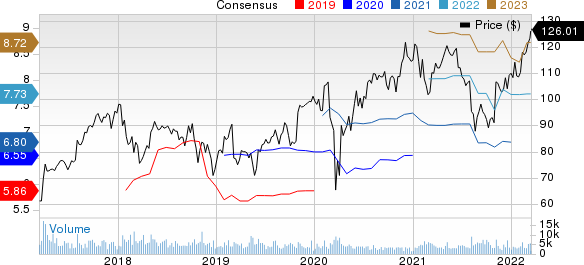

Shares of FMC Corporation FMC scaled a fresh 52-week high of $126.71 on Mar 14, before closing the session at $126.01.

The company, carrying a Zacks Rank #3 (Hold), has a market cap of around $15.5 billion.

Shares of FMC Corp have gained 16% in the past year against a 4% decline of the industry.

Image Source: Zacks Investment Research

What’s Driving FMC Corp?

FMC Corp is benefiting from healthy demand for its industry-leading products, market share gains and new product launches.

FMC Corp’s adjusted earnings per share were $2.16 in the fourth quarter, topping the Zacks Consensus Estimate of $2.02. Revenues were $1,413.6 million in the quarter, up around 22.7% from the year-ago quarter’s levels.

The top line surpassed the Zacks Consensus Estimate of $1,367.6 million. Revenues were driven by a 21% rise in volumes and a 4% contribution from price. The company benefited from a healthy demand environment and price increases.

The company stated that for first-quarter 2022, revenues are projected in the band of $1.22-$1.34 billion, reflecting an increase of 7% at the midpoint compared with the prior-year quarter’s levels. Adjusted earnings are forecast in the range of $1.50-$1.90 per share, calling for an increase of 11% at the midpoint from the prior-year quarter’s levels. It also expects adjusted EBITDA in the range of $300-$350 million for the quarter.

For 2022, FMC expects revenues between $5.25 billion and $5.55 billion, indicating a rise of 7% at the midpoint from 2021 levels. Sales are expected to be driven by higher volumes and prices in all regions.

FMC Corp is benefiting from healthy demand for its products. It is seeing demand strength for its products (diamides and insecticides) in North America on high crop commodity prices. The company also saw higher demand for diamides in India and overall strength in its insecticide portfolio in Asia in the most recent quarter. Demand for the company’s insecticide products in corn and soybean applications is also strong in Brazil, aided by higher planted areas and strong commodity prices. FMC Corp sees pricing to be up mid-single digits in first-quarter 2022, factoring in strong fundamentals. The company expects strong volume growth in 2022 across regions and portfolios.

It is also gaining from continued market share gains and new product introductions (across corn, soybean and cotton markets) in North and Latin America. The company remains focused on investing in technologies and products in its agriculture business and launching new products to enhance value to the farmers. It expects new products launched in the past five years to contribute $600 million to sales in 2022.

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Stocks to Consider

Some better-ranked stocks in the basic materials space are The Mosaic Company MOS, AdvanSix Inc. ASIX and Allegheny Technologies Incorporated ATI.

Mosaic has a projected earnings growth rate of 106.4% for the current year. The Zacks Consensus Estimate for MOS' current-year earnings has been revised 22.2% upward in the past 60 days.

Mosaic beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missing once. It has a trailing four-quarter earnings surprise of roughly 3.7%, on average. MOS has rallied around 75.9% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 20.8% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 15.7% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 23.6%. ASIX has surged 76.9% in a year. The company carries a Zacks Rank #2 (Buy).

Allegheny, currently carrying a Zacks Rank #2, has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI's earnings for the current year has been revised 45.6% upward in the past 60 days.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 20.6% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research