A Foolish Take: Crypto Makes Its Comeback

Investing trends come and go, and often, popular investments come into fashion and then fall out of favor shortly thereafter. Cryptocurrencies have followed that pattern numerous times over the past decade, with the most popular token, bitcoin, having seen its price soar from pennies to more than $20,000 a year and a half ago. Each big move higher has been followed by an equally gut-wrenching fall, with the most recent erasing more than 80% of the past high by February 2019.

However, cryptocurrency has come back in a major way since the winter months. Bitcoin prices have tripled, and many other popular tokens have seen even larger gains. Ethereum has almost quadrupled from its December 2018 lows, and litecoin tokens have risen nearly sixfold over the same six-month time frame.

Bitcoin still rules the roost

Many see the cryptocurrency comeback feeding on itself, with the recent price surge fueling more demand from investors who fear missing out on the next big run for bitcoin. Proponents of cryptocurrencies note how much utility the blockchain technology on which they're based has for the future, whether it's in financial applications or in other areas where security is paramount. Indeed, even social media giant Facebook (NASDAQ: FB) recently joined in on the cryptocurrency trend, expecting to launch a new token called Libra early next year.

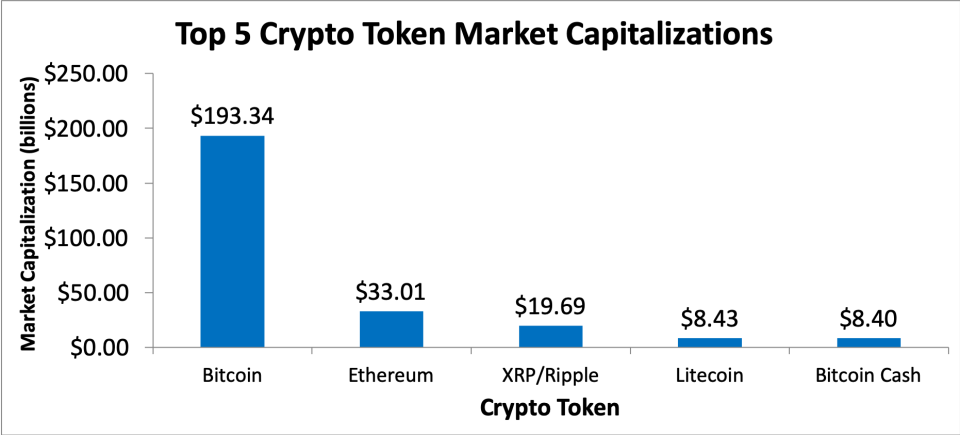

Yet as you can see below, despite there being thousands of crypto tokens available on the market, bitcoin still dominates the market.

Data source: Coinmarketcap.com. Chart by author.

Looking more broadly at available tokens, just 80 or so have values of more than $100 million. Meanwhile, bitcoin's $193 billion market cap is half again as large as the total of the next 100 tokens combined.

For a long time, crypto advocates have believed that the market would eventually evolve beyond bitcoin's first-mover advantage and develop large numbers of competing tokens. For now, though, the health of cryptocurrencies relies on the health of bitcoin, and so its recent return to five-figure status spells good news for those who favor cryptocurrency development.

More From The Motley Fool

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Dan Caplinger has no position in any of the stocks or cryptocurrency tokens mentioned. The Motley Fool owns shares of and recommends Facebook but has no position in the cryptocurrency tokens mentioned. The Motley Fool has a disclosure policy.