Forecasting one-year stock market returns is basically impossible: Morning Brief

Friday, January 3, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Good luck figuring out what stocks do in 2020

Depending on which highly-trained, experienced Wall Street expert you ask, they’ll tell you that stocks are either going up, down, or nowhere in 2020.

Today, we’re going to continue this conversation by considering whether prices, earnings, and price/earnings (P/E) ratios can predict next-year returns with any accuracy. In short, they’re not accurate at all.

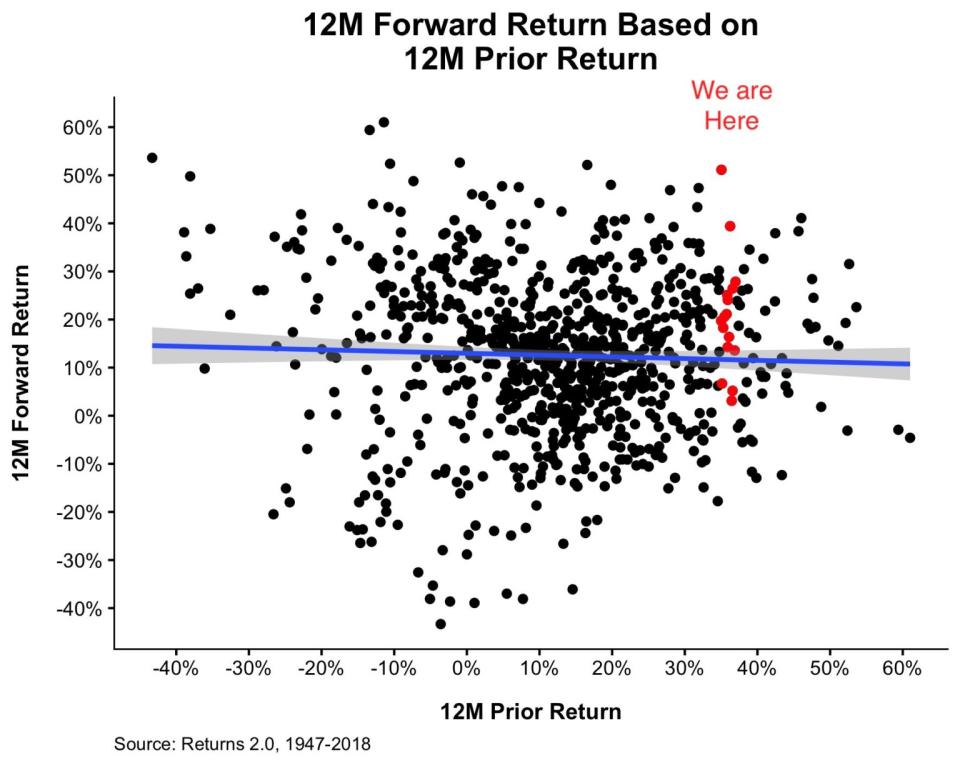

Prices tell us nothing. Consider this chart from Ritholtz Wealth Management’s Michael Batnick and Nick Maggiulli. It reviews the relationship between the last 12 months’ market return with the next 12 months’ market return. The chaos of dots suggest one does little to explain the other. Even when you consider massive one year gains like what we experienced in 2019 (as represented by the red dots), history shows you could be up, down, way up, way down, or flat over the next year.

Maggiulli also considered what the previous 10 years’ worth of returns said about future returns, and again the relationship wasn’t much. Other iterations of this study come to the same conclusion: past performance is no predictor of next-12-month returns.

What about earnings? Morning Brief readers already know that Wall Street’s strategists are still wrestling with where earnings may go in 2020, and historically they’ve never seen an earnings recession coming. But these discussions are moot in the context of predicting the next year’s returns. According to regression analysis done by UBS, there is “ZERO correlation for annual returns and EPS growth.”

But the P/E ratio must tell us something, right? If the P/E is above average, stocks are considered “expensive.” And if it’s below average, stocks are considered “cheap.” So, therefore if the P/E is high, prices should be more likely to fall next year, and vice versa, right?

Wrong.

Goldman Sachs did a regression analysis between the next-12-month P/E and the next-12-month return, and ended up with a very low R-squared of 0.09, which told them, “Valuations are poor predictors of near-term equity returns.”

Even when you apply normalized earnings as is done with the cyclically-adjusted price-earnings (CAPE) ratio, you still don’t know what’ll happen next year. Nobel prize-winning economist Robert Shiller, who popularized CAPE, will even tell you, “CAPE is useful, but it does not provide a clear guide to the future.”

While it’s not easy to predict returns with accuracy, we do at least know that stocks tend to go up. And in any given year, it’s very normal to see a big drawdown before prices go up again. So, be ready for that.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

Construction Spending month-on-month, November (+0.3% expected, -0.8% in October)

ISM Manufacturing, December (49.0 expected, 48.1 in November); ISM Prices Paid, December (47.5 expected, 46.7 in November)

2 p.m. ET: Federal Open Market Committee (FOMC) December meeting minutes

Top News

Oil jumps, stocks sag after US airstrike kills top Iranian general [Yahoo Finance]

Challenger Gray: Layoffs in 2019 hit highest level in four years [Yahoo Finance]

Carlos Ghosn's bizarre escape from Japan raises important questions [Yahoo Finance]

EU Trade Chief Fixes January U.S. Trip in Bid to Ease Tensions [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Why stock market traders should be terrified of robots in the next decade

Early-bird home buyers turn January into the new April: Realtor.com

The first thing to do after you're involved in a hack, according to experts

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.