Forex News: Euro May Extend Advance on Flash PMI Data

THE TAKEAWAY: The Euro may recover further as November’s flash PMI data hints at a possible turnaround after nine consecutive months of deterioration.

What’s Coming Out and When?

November flash PMI figures for the Eurozone are due to be released at 9AM GMT. French and German flash PMI figures for November are also due to be released at 8AM and 8:30AM respectively.

The October flash Eurozone composite reading of 45.7 revealed the ninth straight month of declines and continued to reflect a contraction in the Eurozone economy. Expectations are for the November reading to show a slight recovery to 45.9.

What Could the Flash PMI Releases Mean for the Euro?

This is a particularly important release as an improvement in November may signal that the prolonged contraction in the Eurozone may have reached a turning point. Forex traders have viewed the poor economic performance in the region as the major hurdle for strong global growth and so a better-than-expected reading would be bullish for risk assets and the Euro.

Why is the Flash PMI Data Important?

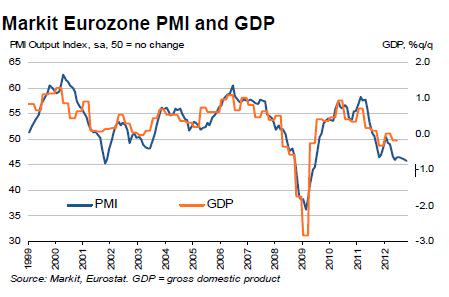

Firstly the flash Eurozone composite reading has historically provided a very good estimate of final PMI. Forex traders pay close attention to PMI figures as they provide a very timely indication of economic growth. A reading below 50 represents a contraction in the economy and a reading of 50 or more represents an expansion. The Eurozone PMI figures have displayed a very strong correlation with actual GDP growth.

What are the Charts Telling Us?

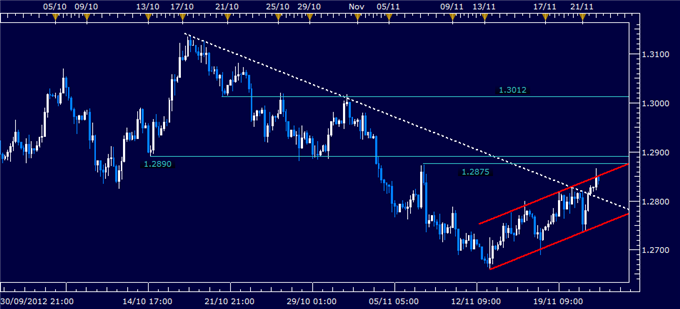

EURUSD took out resistance at a falling trend line set from mid-October to challenge the top of a rising channel established from the November 13 low (now at 1.2851). This is reinforced by horizontal barriers in the 1.2875-90 area. A break above the latter mark broadly exposes the 1.30 figure and 1.3012. Trend line resistance-turned-support is now at 1.2807, with a drop below that aiming for the channel bottom at 1.2749.

EUR/USD Spot – 4hr Chart

Created Using FXCM Marketscope – Prepared by Ilya Spivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.