Forex Strategy: AUD/USD Divergence from Risk Temporary

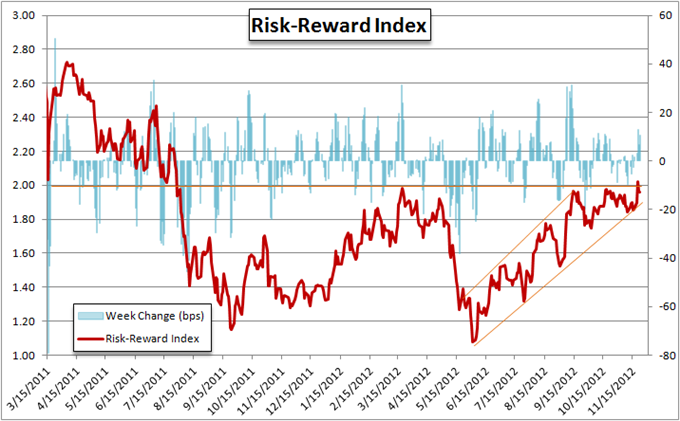

Risk trends this past week have seen a notable improvement – both in the fundamental measures of sentiment (the Risk-Reward Index) as well as the stimulus-leveraged S&P 500. However, between the Index and US equities benchmark, we can see that once again the latter maintains the greatest level of volatility and progress on the bounce. This is yet another reminder that the market’s ideal and simple read on investor sentiment through the US equity markets is still moving outside the common risk band. More importantly, it also speaks to a bigger matter for the broader state of the market: that risk trends themselves are actually lacking for direction and conviction.

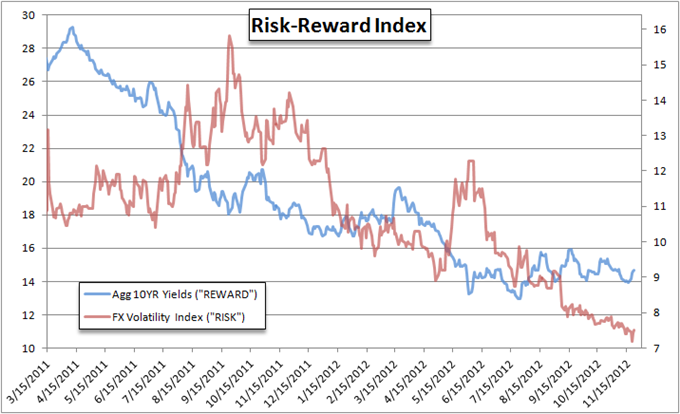

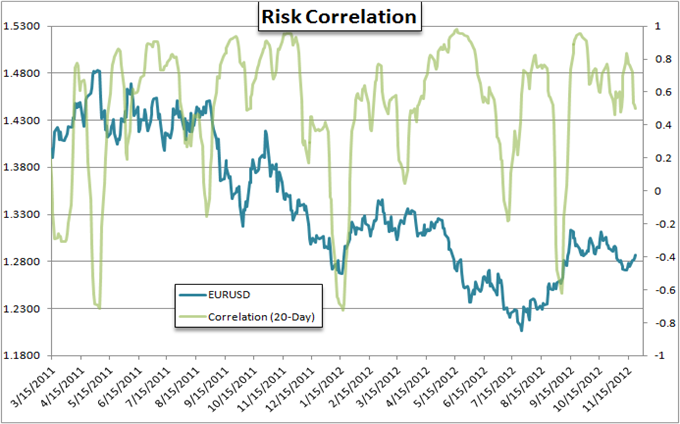

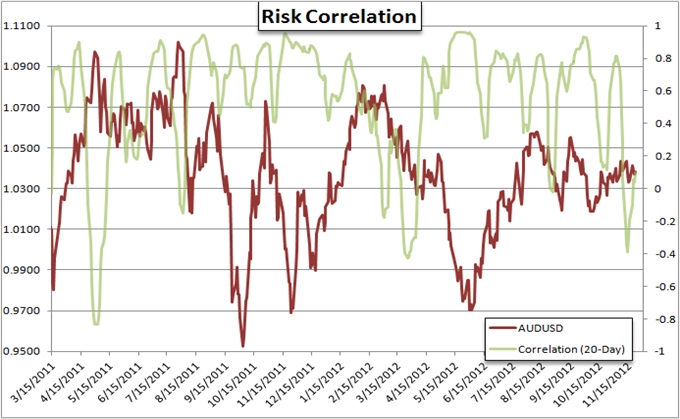

The equilibrium between appetite for yield and fear of unfavorable volatility is an elemental driver for traders across all assets and investment strategies. Yet, the imbalance is not always so severe as to carry a market-wide trend. Rates of return at multi-year lows are made tolerable when concern of volatility is similarly at extreme lows (the mix we are currently facing). And, when there isn’t a strong push to build risky (higher-yielding) positions or flight to safety, we find secondary fundamental concerns – like the escalated effort to drive the yen lower or the IMF’s consideration to add the Canadian and Australian currencies to the ‘reserve status’ list – can carry a greater level of influence. This is where the AUDUSD’s seemingly uncharacteristic deviation from benchmark risk trends originates. That said, this pacification of risk trends can only last so long. Eventually ‘risk’ show a meaningful shift and correlations like those between S&P 500 and the Risk-Reward Index or the S&P 500 and AUDUSD will return.

Read the Introduction to Risk Trends and the Risk-Reward Indicator Here.

Over the past week, we have seen a considerable decline in the concentration of investor sentiment – and it should surprise few. Through October, US equities marked a considerable shift in trend, and the consistency of the move very nearly ignited a similar move in the underlying components of sentiment (which would have pulled the FX markets with it). However, as we can see in the Risk-Reward Index chart above and the comparative chart between the Index and S&P 500 below, emotions never fully caught up to the drive behind the stock market. And, whatever chance there was that fear could take root was delayed / disrupted this week by the US holiday.

Considering there are two factors in the ebb and flow of investor sentiment (risk and reward), a committed risk aversion move requires either expected yield to decline or the outlook for volatility to increase substantially. With returns already stationed at near-historic lows, a sustained decline from here is unlikely. That leaves the fear of volatility as the standout catalyst to ignite the deleveraging that growth forecasts, corporate earnings and financial uncertainties suggest is overdue. Therein lies the reality of risk trends for this week – and possibly through the rest of this year.

When one of the major financial centers of the world (like the US) is offline for an extended market holiday (like this week’s Thanksgiving break), speculative participation naturally dissipates. When volume retreats, the lack of market depth will also temper serious builds in volatility – the official measure of ‘fear’. We knew this lull was coming, and consequently risk trends would be bolstered. That said, we also know the second half of December to be extremely thin on market participation, and the interim between the Thanksgiving pause and end-of-year rebalancing often conforms. Yet, this time around, there are many more hotspots to ignite enough concern to draw investors back to the market and overwhelm the lassitude.

Risk–Reward Index vs Market Standards

It is interesting to note in the risk comparison above that while the Risk-Reward Index resisted the downdraft that the US equity market suffered, it should little hesitation to participate in the subsequent bounce. In fact, the Index temporarily breached the 2.0 market and subsequently tagged a 16-month high in the process. Follow through from there is highly unlikely as we would need to see a strong advance in yields to facilitate a trend (highly unlikely given the downshift in growth). Once again, the fate of underlying market direction from here rests with volatility trends.

If we were to simply see a quiet end to the year, it would almost certainly leave pairs like EURUSD, AUDUSD, AUDJPY, and others within broader ranges that lacks for serious correlation. That said, there is still plenty of opportunity over the next 5 weeks to stir activity and fear to thereby leverage a wholesale risk aversion move. The order of importance for catalysts over the near-term future runs: US Fiscal Cliff, Eurozone Financial crisis, Middle East tensions, Chinese asset and economic growth and Japan’s elections.

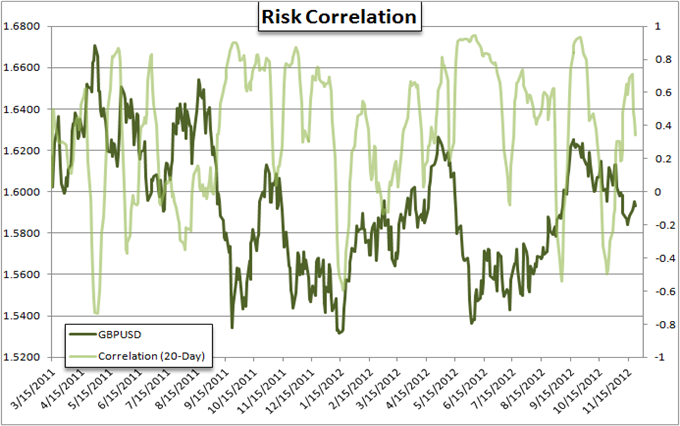

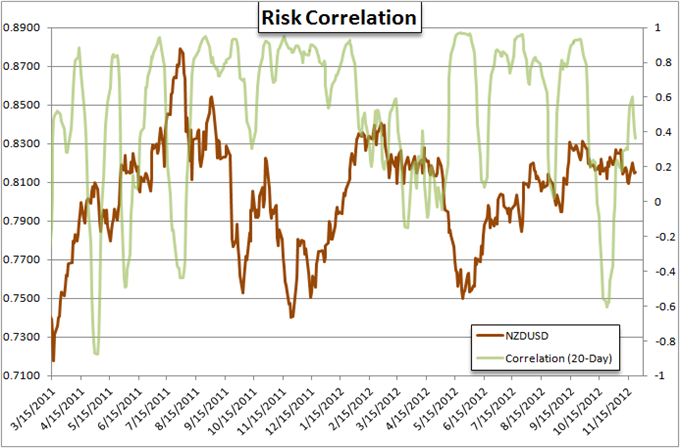

Majors Correlation to Risk Trends (How Influential is Risk Appetite)

Below, are charts that show the price action for the majors against the correlation that the pair runs against the Risk-Reward Index. The closer to 1.0 the correlation, the pair will move in lock step with risk appetite (optimism rises and so does the currency pair). On the other hand, the closer a reading is to -1.0 means the closer the pair moves in exactly the opposite direction but at the same pace as risk trends.

This is valuable information for fundamental traders. If you recognize a currency pair is highly correlated (positively: close to 1.0, or negatively: close to -1.0), we know that we should be watching factors that change sentiment to offer us guidance on that particular pair. Alternatively, the closer to 0.0 the reading, we know that there is less influence from risk trends and we can trade independent of that bigger theme.

--- Written by: John Kicklighter, Chief Strategist for DailyFX.com

To contact John, email jkicklighter@dailyfx.com. Follow me on twitter at http://www.twitter.com/JohnKicklighter

Sign up for John’s email distribution list, here.

Additional Content:Money Management Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.