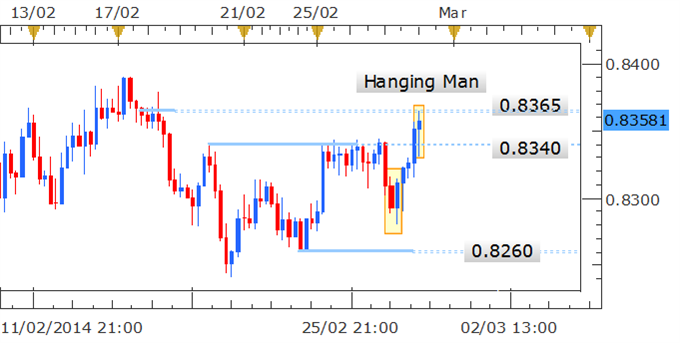

Forex Strategy: NZD/USD Hanging Man Candle Warns Of Declines

To receive David’s analysis directly via email, please SIGN UP HERE

Talking Points

NZD/USD Technical Strategy: Hanging Man prefers shorts

Sellers emerging at 0.8365 mark to cap gains

Targets suggested at psychologically significant levels

A Hanging Man candlestick formation on the four hour chart for NZD/USD at resistance may be warning of fresh declines for the pair. Following a break above resistance at 0.8340 sellers appear to be capping gains for the Kiwi at the 0.8365 level which may offer a potential entry for shorts. As noted in the most recent Kiwi candlesticks report; a Shooting Star formation on the daily had hinted at a reversal with a target of the psychologically significant 0.8300 level.

Confirm your chart-based trade setups with the Technical Analyzer.

4 Hour Chart - Created Using FXCM Marketscope 2.0

--- Written by David de Ferranti, Market Analyst, FXCM

Contact and follow David on Twitter: @Davidde

New to FX? START HERE

For live market updates, visit the Real Time News Feed

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.