Forex Trading Crowds Bet on US Dollar Bounce - Trades Look Attractive

FX Trading crowds are long the US Dollar (ticker: USDOLLAR) against all majors except the Australian Dollar. Those positions might work out well as the USD bounces off key support.

View individual currency sections:

EURUSD - Euro Unlikely to Break Highs - We Like Selling Strength

GBPUSD - Forex Trading Crowd Sentiment Gets it Right as GBPUSD Sells Off

EURJPY - Japanese Yen Eyes Fresh Lows - But When?

XAUUSD - Gold Prices Forecast to Bounce Before Larger Decline

SPX500 - SPX500 Forecast to Trade to Record Peaks

AUDUSD - Australian Dollar Forecast to Hit Fresh Lows

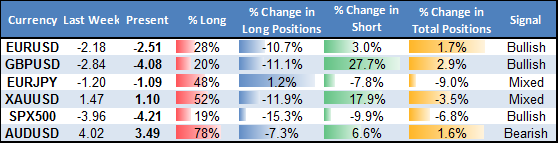

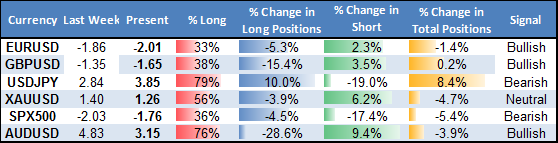

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

The majority of retail traders remain aggressively long the US Dollar (ticker: USDOLLAR) against all major currency pairs except the Australian Dollar. Such one-sided sentiment would normally leave us in favor of Greenback weakness, but low forex market volatility expectations suggest the USD is unlikely to break lows.

Instead we’re broadly in favor of buying any significant US Dollar declines as long as it continues to hold key lows versus the Euro and British Pound. Australian Dollar short positions likewise look attractive on the combination of a broader USD-bullish outlook and an AUDUSD break below important support.

Download all of our Sentiment-based trading strategies free via an ongoing promo on FXCMApps.com

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.