Forget Micron (MU), Buy These 3 Cybersecurity Stocks Instead

Micron Technology MU shares have plunged 42.4% year to date (YTD), making it one of the most beaten-down stocks in the broader market sell-off witnessed by the U.S. equity market so far this year.

Though the majority of the tech stocks have seen a drastic fall in their YTD share prices amid the broader market sell-off, the major concern for Micron is weakening demand for its memory chips. During its recently concluded third-quarter fiscal 2022 earnings conference call, the company stated that consumer spending has softened, resulting in the weakening of the memory chip demand from the smartphone and personal computer end markets.

The scenario would lead to dim financial performances in the next few quarters for Micron. The company’s fourth-quarter revenue guidance of $7.2 billion (+/- $400 million) suggests a year-over-year decline of approximately 13%. Similarly, the adjusted earnings projection of $1.63 per share (+/-20 cents) indicates a year-over-year decline of about 33%.

Historically, the financial performances of chip-making companies have been a key barometer for the broader stock market and economy. Therefore, the grim sales and profit outlook by Micron has sparked worries that the United States is potentially heading for a recession.

In such a scenario, it is prudent for near-term investors to avoid this Zacks Rank #5 (Strong Sell) stock and instead focus on three top-ranked cybersecurity stocks — Palo Alto Networks PANW, CrowdStrike CRWD and Qualys QLYS.

Why Invest in Cybersecurity Stocks?

Cybersecurity stocks have remained more resilient amid the broader market sell-off this year so far as organizations continue spending more on protecting themselves from rising cyberattack threats.

Increasing requirement for privileged access security on the back of digital transformation and cloud migration strategies is also fueling the demand for cybersecurity solutions. The COVID-19 pandemic has further increased cyber onslaughts as businesses of all sizes are transitioning their operations to various online platforms.

From education to entertainment, working to shopping, and even healthcare has gone virtual, causing high technology percolation in everyday lives. This puts not only businesses but also schools, hospitals and other organizations at the receiving end of online assaults.

While public institutions and large companies have always been the target of hackers, smaller organizations with lower security standards are also on their radars.

Further, the advent of 5G will enable other devices to connect to the Internet, thereby expanding the scope of Internet of Things (IoT) and artificial intelligence (AI). While IoT and AI will simplify things, they will also aggravate the rate of cybercrime with increased reliance on technology.

A report by Fortune Business Insights stated that the global cybersecurity market is expected to reach $376.32 billion by 2029 from a projected $155.83 billion in 2022, exhibiting a CAGR of 13.4% from 2022 to 2029.

Considering the aforementioned factors, it is therefore advisable to invest in cybersecurity stocks in the near term. We have taken the help of the Zacks Stock Screener to shortlist the abovementioned three cybersecurity stocks that are incredible for investments. These stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy).

Also, the stocks have a Growth Score of A or B. Per Zacks’ proprietary methodology, stocks with such a favorable combination offer solid investment opportunities.

3 Cybersecurity Stocks to Bet On

Palo Alto Networks: The company currently carries a Zacks Rank #2 and has a Growth Score of B. It is benefiting from increased adoption of its next-generation security platforms, driven by a rise in remote working policy among top-notch companies. The cyber security firm continues to win back-to-back deals for offering unique cyber safety solutions, which block attacks or malicious content. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company's current subscription-based model is aiding it in generating stable revenues while expanding margins. Palo Alto's subscription-based services like AutoFocus, Aperture, Traps, WildFire and Virtual are not only witnessing solid growth but also bolstering the customer base. These might help the cybersecurity firm to improve both the top and the bottom lines.

The Zacks Consensus Estimate for fourth-quarter fiscal 2022 earnings has been revised upward by 7 cents to $2.28 per share over the past 60 days. The consensus mark for fiscal 2022 earnings has been revised upward by 18 cents to $7.45 per share.

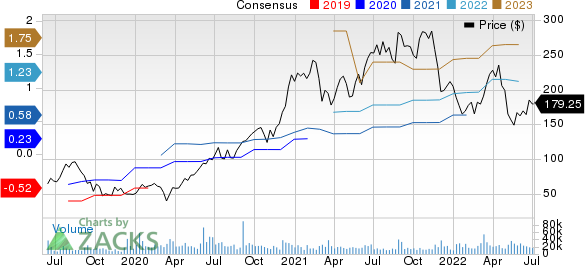

Palo Alto Networks, Inc. Price and Consensus

Palo Alto Networks, Inc. price-consensus-chart | Palo Alto Networks, Inc. Quote

CrowdStrike: It is a leader in next-generation endpoint protection, threat intelligence and cyberattack response services. The company is benefiting from the rising demand for cyber-security solutions owing to a slew of data breaches and the increasing necessity for security and networking products amid the pandemic-led remote working trend.

Continued digital transformation and cloud-migration strategies adopted by organizations are key growth drivers. CrowdStrike’s portfolio strength, mainly the Falcon platform’s 10 cloud modules, boosts its competitive edge and helps add users. Additionally, strategic acquisitions, like that of Humio and Preempt, are expected to drive growth.

CrowdStrike carries a Zacks Rank #2 and has a Growth Score of A. The Zacks Consensus Estimate for CRWD’s third-quarter fiscal 2023 earnings has improved by 3 cents to 29 cents per share over the past 30 days. For fiscal 2023, the consensus mark for earnings has been revised upward by 10 cents to $1.23 per share over the past 30 days.

CrowdStrike Price and Consensus

CrowdStrike price-consensus-chart | CrowdStrike Quote

Qualys: The company offers cloud security and compliance solutions that enable organizations to identify security risks to their information technology infrastructures, thus helping protect their IT systems and applications from cyber-attacks.

Qualys is gaining from the surging demand for security and networking products amid the coronavirus crisis as a massive global workforce is working remotely. Accelerated digital transformations by organizations are also fueling demand for the company’s cloud-based security solutions.

QLYS currently carries a Zacks Rank #2 and has a Growth Score of A. The Zacks Consensus Estimate for third-quarter 2022 earnings has been revised upward by 4 cents to 74 cents per share over the past 60 days. The consensus mark for 2022 earnings has been revised upward by 25 cents to $3.15 per share.

Qualys, Inc. Price and Consensus

Qualys, Inc. price-consensus-chart | Qualys, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Qualys, Inc. (QLYS) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research