Forget Zimmer Biomet (ZBH), Buy These 3 Medical Devices Stocks

Shares of Zimmer Biomet ZBH have registered an extremely tepid performance so far in 2021, in line with the broader orthopedic industry’s declining volume trend. Through the first half of the year, the situation seemed to improve for Zimmer Biomet on the gradual opening of the economy following the lifting of strict social-distancing norms and increased hospital visits. There was a rush toward earlier-deferred non-COVID elective orthopedic treatments after the widespread vaccination drives.

However, this improving scenario did not last long. In the second half of the year, with increasing cases of infections due to the emergence of new virus variants, patients once again started deferring their elective orthopedic surgeries in fear of getting infected by the latest potentially vaccine-resistant strains on hospital visits. Hospitals too were seen to increasingly attend to COVID-19 patients, thereby pushing orthopedic patient admissions to the back. This has significantly hampered 2021 second-half sales of Zimmer Biomet, leading to a bearish run on the bourse for the stock.

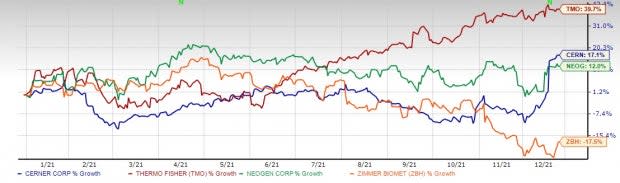

Year to date, Zimmer Biomet has plunged 17.5% against the S&P 500 index’s growth of 26.9%. Earnings estimates for 2021 and 2022 have decreased by 5.3% and 6.5%, respectively, over the past three months .

Given the fact that a meaningful portion of the orthopedic space comprises nonessential, deferrable surgeries, the adverse business impacts are likely to stay in the coming months as well. In such a scenario, we ask investors to avoid orthopedic stocks like Zimmer Biomet, which carries a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In contrast, there are a number of medical device players with nonelective, essential and/or COVID-support procedures and treatments, which have confirmed a gradual rebound in their base businesses. We ask investors to capitalize on the sustained uptrend of these medical device stocks like Thermo Fisher Scientific TMO, Neogen NEOG and Cerner CERN that have either well-adapted to the changing consumer preference or have capitalized on growth in COVID-19-based businesses.

YTD Price Performance

Image Source: Zacks Investment Research

Before discussing these stocks, let’s delve deeper on the prime factors that are weighing on ZBH stock at present:

What’s Weighing on Zimmer Biomet?

Zimmer Biomet registered soft sales volume particularly in the America in the last reported quarter. In terms of operating segments, the company’s core divisions like Knees, Hips, and Dental & Spine registered significant year-over-year declines in revenues at CER. In the quarter, Zimmer Biomet continued to face COVID-induced challenges and market pressure. According to the company, the third quarter was full of unexpected negative environmental impacts that were mostly out of control.

The quarter brought greater COVID pressure than expected for Zimmer Biomet. The company recognized customer staffing shortages severe than expected and an unanticipated impact of China VBP both of which resulted in lower-than-projected Q3 revenues. According to Zimmer Biomet, the business recovery continued in August but then declined in September as the company saw Delta variant cases and increase in staffing shortage.

On the third-quarter earnings call, the company stated that it expects these issues to continue into Q4 as well. In view of a lackluster Q4 projection, Zimmer Biomet also had to slash its 2021 financial guidance. The company even expects these negative trends to persist in early 2022 as well.

Why Invest in Medical Device Stocks Now?

Despite the ongoing problem of supply disruption and staffing shortage in the face of the emergence of the Omicron variant of COVID-19, which has been identified by WHO, as a variant of concern, a number of medical device companies are experiencing substantial recovery because of their nature of business. Amid the pandemic concerns, there has been rising utilization of minimally-invasive robot-assisted surgeries, self-automated home-based care, use of IT for quick and improved patient care, and shift of the payment system to a value-based model, underscoring the growing influence of AI in the Medical Products space.

This apart, amid the rising number of COVID cases, demand for molecular diagnostic and rapid testing, as well as other COVID-19 support products, has surged. The need of the hour is testing, which has led to a shift in the pipeline of IVD products, with a large number of rapid, point-of-care devices going into development. We currently anticipate significant demand for rapid diagnostic testing through 2022 as well.

3 Medical Device Stocks Set to Earn Big in 2022

Thermo Fisher Scientific: The company has been delivering stable business performance, leveraging on a significant rebound in its base business. Thermo Fisher’s Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, and Laboratory Products and Services all have registered strong growth in the recent quarters. In the last-reported third quarter, Thermo Fisher generated $2.05 billion in COVID-19 response-related revenues. With the surge in the Delta and Omicron variants, the company projects strong testing demand globally in the fourth quarter. Thermo Fisher is also playing a meaningful role in vaccines and therapies for COVID-19, generating just over $500 million in the last-reported quarter in this space. Year-to-date, the stock has improved 39.7%.

The Zacks Consensus Estimate for this Zacks Rank #2 (Buy) company’s 2022 sales is pegged at $39.83 billion, indicating a 7.3% rise from 2021. Thermo Fisher’s long-term expected earnings growth rate is pegged at 14%.

Neogen: Neogen exited the first quarter of fiscal 2022 on a bullish note with better-than-expected revenues and earnings. Top-line growth was led by strength in the company’s Food Safety and Animal Safety business segments. The newly launched AccuPoint Advanced NG contributed to growth in environmental sanitation. The ThyroKare supplement drove revenues in animal care products. The StandGuard product line also contributed to growth. Integration of the Megazyme product offerings into Neogen’s product portfolio looks encouraging. Neogen’s solid domestic and international performance across all businesses buoys optimism as well. Expansion of gross margin is an added advantage. Neogen carries a Zacks Rank #2. Year to date, the stock has improved 12%.

The Zacks Consensus Estimate for this Neogen’s fiscal 2022 (ending May 2022) sales is pegged at $527.9 million, indicating a 12.7% rise. The same for earnings of 66 cents suggests growth of 15.8%. Neogen’s long-term historical earnings growth rate is pegged at 8.6%.

Cerner: This healthcare information technology (HCIT) solutions provider registered solid gains in four of the company’s business in the last-reported quarter. Bookings witnessed growth (23%) in the quarter under review. Apart from this, Cerner repurchased shares worth $375 million in the quarter under review. Per management, the solid performance reflected the company’s robust progress in its transformation initiatives, cost control measures and a strong market presence. On the basis of this progress, Cerner increased its earnings outlook for 2021 yet again. Besides, Cerner continued to make substantial progress in its work with the Federal government, which includes expansion of interoperability capabilities that are important for the success of the Veterans Affairs (VA) and the Department of Defense (DoD) programs. This Zacks Rank #2 stock has risen 17.1% year to date.

The Zacks Consensus Estimate for Cerner’s 2022 sales is pegged at $6.08 billion, indicating a 4.8% rise. The same for earnings of $3.68 suggests growth of 11.6%. Cerner’s long-term expected earnings growth rate is pegged at 13.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cerner Corporation (CERN) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research