The Forterra (NASDAQ:FRTA) Share Price Has Gained 186%, So Why Not Pay It Some Attention?

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Forterra, Inc. (NASDAQ:FRTA) share price had more than doubled in just one year - up 186%. Also pleasing for shareholders was the 24% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. On the other hand, longer term shareholders have had a tougher run, with the stock falling 29% in three years.

View our latest analysis for Forterra

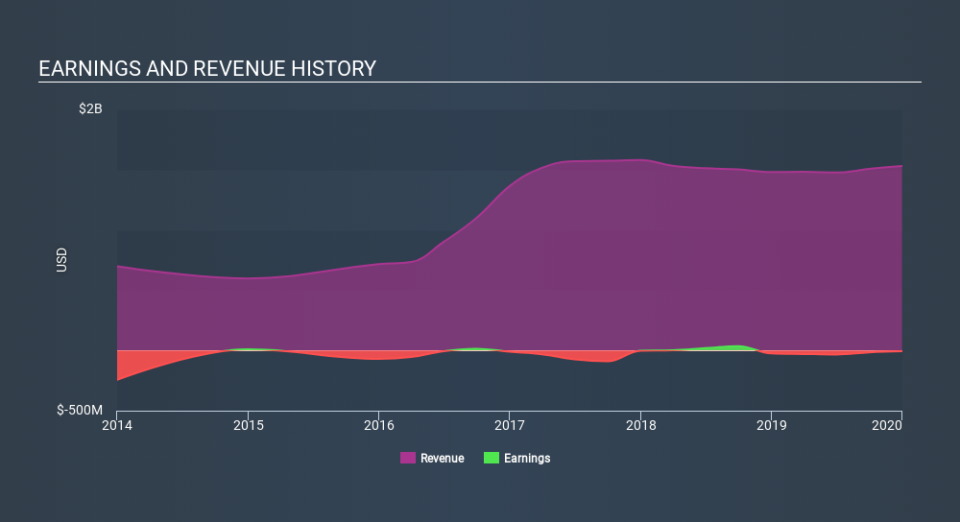

Given that Forterra didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Forterra's revenue grew by 3.4%. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 186%. The business will need a lot more growth to justify that increase. We're not so sure that revenue growth is driving the market optimism about the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pleasingly, Forterra's total shareholder return last year was 186%. That certainly beats the loss of about 11% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Forterra has 1 warning sign we think you should be aware of.

Forterra is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.