Fortive (FTV) Q2 Earnings & Revenues Beat Estimates, Up Y/Y

Fortive Corporation FTV reported second-quarter 2022 adjusted earnings of 78 cents per share, outpacing the Zacks Consensus Estimate by 8.3%. The figure also increased 18.2% year over year.

Revenues increased 10.9% year over year to $1.46 billion and beat the Zacks Consensus Estimate by 3.6%. Also, core revenues moved up 8.9% from the year-ago quarter’s levels.

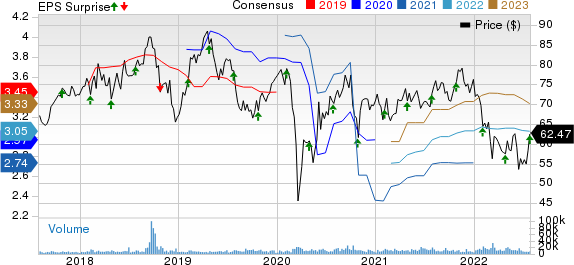

Fortive Corporation Price, Consensus and EPS Surprise

Fortive Corporation price-consensus-eps-surprise-chart | Fortive Corporation Quote

The top line was driven by strong customer demand, especially in North America and Western Europe. However, this was partly offset by persistent supply-chain troubles and the reimposition of lockdown in certain parts of the world. Hardware backlog was up by 21% for the year-to-date period.

In the past year, shares of Fortive have lost 9.5% compared with the industry’s decline of 18.1%.

Image Source: Zacks Investment Research

Top Line in Detail

Fortive operates under the following three organized segments.

Intelligent Operating Solutions: The segment generated revenues of $630 million (contributing 43.1% to total second-quarter revenues), up 16.3% on a year-over-year basis.

Precision Technologies: This segment generated revenues of $499 million (34.1% of total revenues), up 5.8% from the prior-year quarter’s levels.

Advanced Healthcare Solutions: This segment generated revenues of $334 million (22.8% of total revenues), increasing 9.2% from the prior-year quarter’s levels.

Operating Details

In the quarter under review, the adjusted gross margin came in at 57%, which contracted 30 basis points (bps) year over year.

Total operating expenses were $601.2 million, up 10.5% year over year. As a percentage of revenues, selling, general & administrative expenses were 33.1%, contracted 145 bps year over year. Research & development costs, as a percentage of revenues, expanded 19 bps year over year to 6.8%.

Adjusted operating margin was 24.1%, expanding 190 bps on a year-over-year basis.

Segment-wise, the adjusted operating margin from Intelligent Operating Solutions came in at 28.8%, which expanded 30 bps year over year.

Precision Technologies’ adjusted operating margins of 23.8% expanded 90 bps year over year. Advanced Healthcare Solutions’ adjusted operating margins of 23.1% rose 300 bps.

Balance Sheet & Cash Flow

As of Jul 1, 2022, cash and cash equivalents were $682.9 million compared with $684.3 million on Mar 31, 2022.

Accounts receivables were $940.9 million in the reported quarter compared with $929 million in the prior quarter.

The company generated an operating cash flow of $294.4 million compared with $214.8 million reported in the previous quarter.

Free cash flow came in at $276 million compared with $196 million in the prior quarter.

Guidance

For third-quarter 2022, management expects adjusted net earnings in the range of 74-77 cents per share. The corresponding Zacks Consensus Estimate for the quarter is pegged at 78 cents per share.

Revenues are projected in the range of $1.430-$1.455 billion. The corresponding Zacks Consensus Estimate for the quarter is pegged at $1.45 billion. For the quarter, the company expects the adjusted operating margin to be around 23.8%. Free cash flow is expected to be $300 million.

For 2022, Fortive expects adjusted net earnings in the range of $3.07-$3.13 per share. The Zacks Consensus Estimate for the same is pegged at $3.05 per share.

Revenues are projected in the range of $5.775-$5.825 billion compared with the earlier guidance of $5.765-$5.875 billion. The corresponding Zacks Consensus Estimate for the same is pegged at $5.77 billion.

For 2022, the company expects an adjusted operating margin to be around 24.1%. Free cash flow is expected to be around $1.17 billion.

Zacks Rank & Stocks to Consider

Currently, Fortive has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader technology space are Aspen Technology AZPN, Synopsys SNPS and InterDigital Inc. IDCC. Aspen Technology, Synopsys and InterDigital each carry a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.49 per share, increasing 0.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.3%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 34.2% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.67 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 27% in the past year.

The Zacks Consensus Estimate for InterDigital’s 2022 earnings is pegged at $2.76 per share, declining 15.9% in the past 60 days. The long-term earnings growth rate is anticipated to be 15%.

InterDigital’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 141.1%. Shares of IDCC have declined 7.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research