Some Fortune Brands Home & Security (NYSE:FBHS) Shareholders Are Down 19%

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

While it may not be enough for some shareholders, we think it is good to see the Fortune Brands Home & Security, Inc. (NYSE:FBHS) share price up 25% in a single quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 19% in one year, under-performing the market.

View our latest analysis for Fortune Brands Home & Security

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

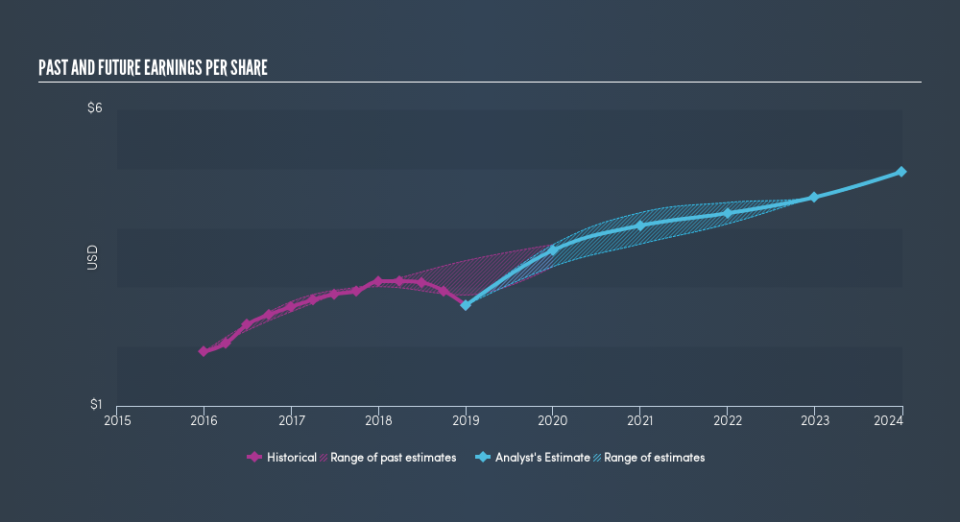

Unfortunately Fortune Brands Home & Security reported an EPS drop of 13% for the last year. The share price decline of 19% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We've already covered Fortune Brands Home & Security's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Fortune Brands Home & Security's TSR, which was a 18% drop over the last year, was not as bad as the share price return.

A Different Perspective

Fortune Brands Home & Security shareholders are down 18% for the year (even including dividends), but the market itself is up 8.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3.8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before spending more time on Fortune Brands Home & Security it might be wise to click here to see if insiders have been buying or selling shares.

But note: Fortune Brands Home & Security may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.