Fossil Posts Narrower-Than-Expected Q1 Loss, Connected Watches Almost Double

Fossil Group Inc. FOSL just released its latest quarterly financial results, posting earnings of a loss of 99 cents per share and revenues of $569 million.

Currently, FOSL is a #3 (Hold), but that could change based on today’s results. Shares of the company have gained about 16% over the past month, and were up almost 13% during regular trading hours today.

The stock is currently down about 0.55% to $16.35 per share in after-hours trading shortly after its earnings report was released.

Fossil:

Beat earnings estimates. The company reported earnings of a loss of 99 cents per share, surpassing the Zacks Consensus Estimate of -$1.05 per share. Net loss for the quarter was $(48.3) million.

Beat revenue estimates. The company saw revenue figures of $569 million, easily topping our consensus estimate of $539.39 million but falling 2.2% year-over-year.

Fossil said that watches declined in the Americas and Europe but increased in Asia, with growth in connected watches. Connected watches almost doubled, while FOSSIL brand watch sales grew 4% globally.

However, the company saw decreases in traditional watches in all geographies on a constant currency basis.

Global retail comps increased 5% compared to the first quarter of 2017.

For fiscal 2018, Fossil expects net sales in the range of (12)% to (5)% and gross margin in the range of 51% to 53%.

“We had an encouraging start to the year, delivering first quarter sales results that were stronger than our expectations. This performance reflects the disciplined execution of our strategy which capitalizes on our strong design, innovation, distribution and operating capabilities. These core capabilities, when combined with powerful global brand portfolio, drove our connected watch sales and helped improve traditional watch performance, while increasing efficiencies across our enterprise,” said CEO and Chairman Kosta Kartsotis.

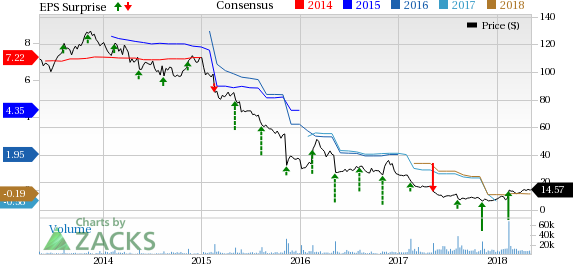

Here’s a graph that looks at Fossil’s recent earnings performance:

Fossil Group, Inc. Price, Consensus and EPS Surprise

Fossil Group, Inc. Price, Consensus and EPS Surprise | Fossil Group, Inc. Quote

Fossil is involved in designing, marketing and distributing consumer fashion accessories. The company's product portfolio include men's and women's watches, handbags, belts, small leather goods, jewelry, sunglasses, hats, gloves and scarves, jeans, outerwear, fashion tops and bottoms, t-shirts, and optical frames. Its brands include MICHELE, Zodiac, Relic, Emporio Armani, DKNY, Armani Exchange, Michael Kors, Diesel, Burberry, Marc by Marc Jacobs, Adidas, Skagen Denmark, and Karl Lagerfeld. Fossil is based in Richardson, Texas.

Check back later for our full analysis on FOSL’s earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fossil Group, Inc. (FOSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research