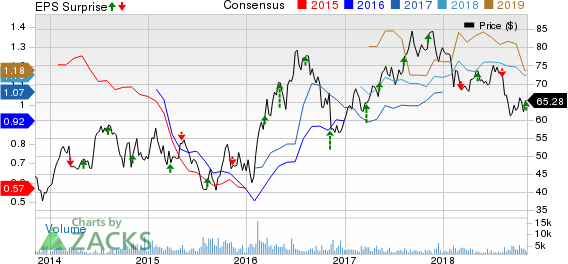

Franco-Nevada (FNV) Q3 Earnings and Revenues Beat Estimates

Franco-Nevada Corporation FNV delivered net earnings of $54.6 million or 29 cents per share for third-quarter 2018, ahead of the Zacks Consensus Estimate of 26 cents per share. The company reported net earnings of $55.3 million or 30 cents in the prior-year quarter.

The company generated revenues of $171 million in the third quarter, declining 0.5% from the year-ago quarter. The figure beat the Zacks Consensus Estimate of $164 million. In the reported quarter, 82.1% of the revenues were sourced from precious metals (64.8% gold, 12.0% silver and 5.3% platinum group metals).

The company sold 120,021 Gold Equivalent Ounces in the quarter, down 3% from 123,787 Gold Equivalent Ounces in the prior-year quarter.

Franco-Nevada Corporation Price, Consensus and EPS Surprise

Franco-Nevada Corporation price-consensus-eps-surprise-chart | Franco-Nevada Corporation Quote

In the reported quarter, adjusted EBITDA was $135 million, up 0.4% from $134 million a year ago.

Prices

At third-quarter end, the average gold price was at $1,218 per ounce, approximately 5% lower than the year-ago quarter. Silver prices averaged $14.99 per ounce in the third quarter, decreasing 11% year over year. Platinum fell 15% year over year to $814 per ounce while palladium prices increased 6% year over year to $953 per ounce.

Financial Position

Franco-Nevada’s cash and cash equivalents fell to $77 million as of Sep 30, 2018, down substantially from $511 million as of Dec 31, 2017. The company recorded operating cash flow of $377 million for the nine-month period ended Sep 30, 2018 compared with $362 million in the prior-year comparable period.

On Oct 23, 2018, Franco-Nevada contributed $214.8 million to close its previously announced transaction with Continental Resources, Inc. to acquire mineral rights in the SCOOP and STACK plays of Oklahoma. Franco-Nevada has also committed, subject to satisfaction of agreed upon development limits, to spend up to $300 million over the next three years to acquire additional mineral rights through a newly-formed company.

Franco-Nevada’s board of directors declared a quarterly dividend of 24 cents per share. The dividend will be paid on Dec 20, 2018 to shareholders of record on Dec 6, 2018.

2018 Guidance for Oil & Gas Assets Hiked

The company now anticipates revenues between $75 million and $85 million from its oil & gas assets for 2018, up from its previous guidance of $65 million to $75 million to reflect the continued strong performance of the oil & gas assets. The company expects the WTI oil price will average $65 per barrel for the balance of the year.

Subsequent to third-quarter end, Franco-Nevada made the final installment on the $1 billion funding commitment for the Cobre Panama project. Revenues are anticipated to increase by more than 30% once the Cobre Panama project ramps-up towards full production over the next two years. In 2019, Candelaria is expected to return to normal operations. Additionally, the continued development of its U.S. oil & gas assets will drive more than 30% increase in revenue and EBITDA, going forward.

The company currently carries a Zacks Rank #4 (Sell). The shares of Franco-Nevada have plunged 22% over the past year, against the industry’s decline of 18%.

Stocks to Consider

A few better-ranked stocks in the basic materials space are CF Industries Holdings, Inc. CF, KMG Chemicals, Inc. KMG and The Mosaic Company MOS.

CF Industries has an expected long-term earnings growth rate of 6% and a Zacks Rank #1 (Strong Buy). The company’s shares have gained 32% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

KMG Chemicals has an expected long-term earnings growth rate of 28.5% and a Zacks Rank #2 (Buy). Its shares have risen 47% in the past year.

Mosaic has an expected long-term earnings growth rate of 7% and a Zacks Rank #2. The company’s shares have rallied 62% over a year’s time.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KMG Chemicals, Inc. (KMG) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

To read this article on Zacks.com click here.