Freeport-McMoRan Inc.'s (NYSE:FCX) recent 4.3% pullback adds to one-year year losses, institutional owners may take drastic measures

If you want to know who really controls Freeport-McMoRan Inc. (NYSE:FCX), then you'll have to look at the makeup of its share registry. We can see that institutions own the lion's share in the company with 80% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

And so it follows that institutional investors was the group most impacted after the company's market cap fell to US$42b last week after a 4.3% drop in the share price. Needless to say, the recent loss which further adds to the one-year loss to shareholders of 1.1% might not go down well especially with this category of shareholders. Institutions or "liquidity providers" control large sums of money and therefore, these types of investors usually have a lot of influence over stock price movements. As a result, if the decline continues, institutional investors may be pressured to sell Freeport-McMoRan which might hurt individual investors.

In the chart below, we zoom in on the different ownership groups of Freeport-McMoRan.

View our latest analysis for Freeport-McMoRan

What Does The Institutional Ownership Tell Us About Freeport-McMoRan?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

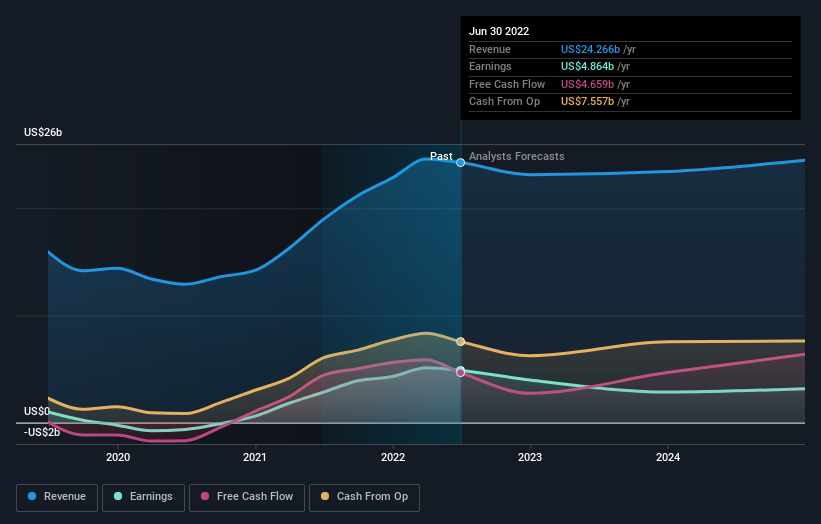

We can see that Freeport-McMoRan does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Freeport-McMoRan, (below). Of course, keep in mind that there are other factors to consider, too.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Hedge funds don't have many shares in Freeport-McMoRan. The Vanguard Group, Inc. is currently the company's largest shareholder with 8.2% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 7.8% and 7.5%, of the shares outstanding, respectively.

After doing some more digging, we found that the top 18 have the combined ownership of 50% in the company, suggesting that no single shareholder has significant control over the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Freeport-McMoRan

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own less than 1% of Freeport-McMoRan Inc.. As it is a large company, we'd only expect insiders to own a small percentage of it. But it's worth noting that they own US$177m worth of shares. In this sort of situation, it can be more interesting to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 20% stake in Freeport-McMoRan. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Freeport-McMoRan better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Freeport-McMoRan you should be aware of, and 1 of them is a bit unpleasant.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here