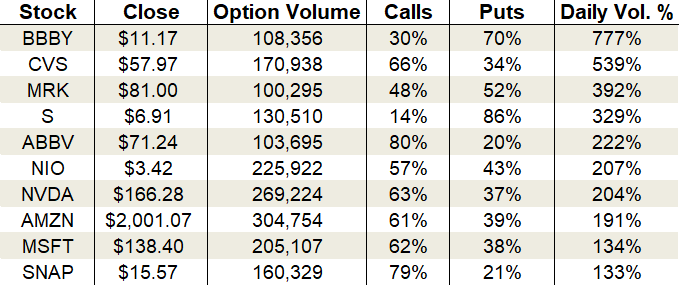

Friday’s Vital Data: Bed Bath & Beyond, CVS and Merck

In early morning trading, futures on the Dow Jones Industrial Average are up 0.29%, and S&P 500 futures are higher by 0.22%. Nasdaq-100 futures have added 0.20%.

Source: Shutterstock

In the options pits, calls continued their usual leadership role on Thursday, while overall volume settled to average levels. Specifically, about 18 million calls and 14.4 million puts changed hands on the session.

Meanwhile, over at the CBOE, the single-session equity put/call volume ratio normalized after Wednesday’s super low reading. The metric climbed back to 0.61 to end in the location of the 10-day moving average.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Options traders swarmed the following three stocks. Bed Bath & Beyond (NYSE:BBBY) continued its trend of earnings deterioration with weak numbers for the fiscal first-quarter. Merck (NYSE:MRK) and CVS Health (NYSE:CVS) both saw sharp moves following news that the White House was ending its drug rebate plans.

Let’s take a closer look:

Bed Bath & Beyond (BBBY)

A quick Google search following this week’s earnings release for ailing retailer, Bed Bath & Beyond, reveals a litany of ominous-sounding headlines. And, well, they’re all probably justified. For the fiscal first-quarter, the company posted a loss of $2.91 per share. After adjusting for miscellaneous items, however, earnings came in at 12 cents per share, marking a 68% decline. Comps were down 6.6%, and revenue grew to $2.57, which was well below last year’s $2.75 billion in the same quarter.

Sellers took to the streak driving BBBY stock as low as $10.43 before a rapid recovery carried it back near the high of the day. The chart continues to look like garbage, warning anyone who cares about technical analysis to stay far away. That said, the intraday rebound was impressive and could deliver some short-term relief.

On the options trading front, puts were all the rage. Total activity ballooned to 777% of the average daily volume, with 108,356 contracts traded; 70% of the trading came from call options alone.

The expected move ahead of earnings was $1.54 or 13.3%, so with the stock rallying back to near unchanged on the session, anyone who shorted volatility before the report and held steady through the morning drop came out a big winner.

CVS Health (CVS)

CVS Health has been in decline for years, but scored a rare win yesterday after the White House halted plans that “would have curtailed rebates that drug manufacturers pay pharmacy benefit managers (PBMs) in return for winning placement of high-priced products on lists of drugs that insurers cover with affordable co-pays.”

Although CVS stock closed up 4.68% on the session, it was mostly a sell-the-news reaction. It was up as much as 8.6% before sellers swarmed and capitalized on the gift. The chart still looks terrible, but Thursday’s jump did complete a five-month basing pattern, so there is a chance that a short-term bottom has been put in place.

On the options trading front, optimism drove traders into call options throughout the session. By day’s end, activity grew to 539% of the average daily volume, with 170,938 total contracts traded. Calls claimed 66% of the session’s sum.

Implied volatility jumped to 31% or the 41st percentile of its one-year range. Premiums are now pricing in daily moves of $1.13 or 1.9%.

Merck (MRK)

CVS Health wasn’t the only stock impacted by the White House announcement. Companies that manufacture and sell drugs like Merck were whacked after the news. Barrons has an insightful take you can find here.

The single day 4.5% drop took some $7 billion off the market cap of MRK stock and pushed it back below its 50-day moving average. The uptrend is now on shaky footing, and the stock is in technical no man’s land. If the weakness persists, use $77 as your first downside target. It would take a recovery to $85 before negating the bearish signals created by Thursday’s swoon.

On the options trading front, put popularity only slightly edged out calls. By the closing bell, activity climbed to 392% of the average daily volume, with 100,295 total contracts traded. Puts accounted for 52% of the take.

The plunge did light a fire under implied volatility, driving the measure up to 24% or the 52nd percentile of its one-year range. Premiums are officially pumped, suggesting short options strategies are the way to go if you’re inclined to trade here.

As of this writing, Tyler Craig didn’t hold a position in any of the aforementioned securities. Check out his recently released Bear Market Survival Guide to learn how to defend your portfolio against market volatility.

More From InvestorPlace

The post Friday’s Vital Data: Bed Bath & Beyond, CVS and Merck appeared first on InvestorPlace.