Friday’s Vital Data: Facebook, Netflix and General Electric Company

U.S. stock futures are headed lower this morning. The Donald Trump administration officially imposed tariffs on $34 billion in Chinese imports today. China has responded in kind with equal tariffs. The trade-war escalation has Wall Street on edge this morning, as it awaits the June non-farm payrolls report.

Heading into the open, futures on the Dow Jones Industrial Average have lost 0.0.3%. Meanwhile, the S&P 500 futures gained 0.04% and Nasdaq-100 futures have gained 0.14%.

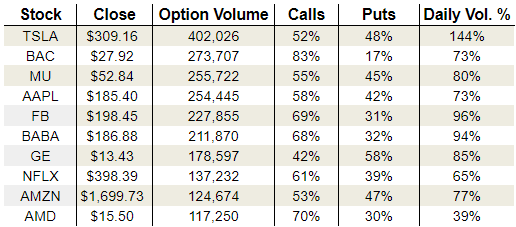

In options activity, volume began to come back on Thursday. Overall, about 15.1 million calls and 13.1 million puts changed hands on the session. On the CBOE, the single-session equity put/call volume fell to 0.60. The 10-day moving average held at 0.61.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Options traders returned to FAANG stocks on Thursday. Facebook (NASDAQ:FB) topped the list after BITG lifted its price target on the shares. Netflix Inc. (NASDAQ:NFLX) options were also popular after a report from Cowen & Co. said it was more popular than cable. Finally, General Electric Company (NYSE:GE) attracted a wealth of put volume after rebounding from support near $13.

Let’s take a closer look:

Facebook (FB)

FB stock jumped nearly 3% on Thursday following a bullish note from BTIG. The ratings firm reiterated its “buy” rating lifted its price target to $275 from $175. FB stock is an “absolute monster,” BTIG said in a note, and that consumers “simply could not care less” about this year’s privacy scandal.

FB options traders returned to bullish form as a result. Volume topped 227,000 contracts on the session. But, while activity was a touch light due to the holiday, call activity was spot on at 69% of the stock’s total float — on par with historical daily call percentages for FB stock.

There is still a fair amount of catch up left to be played, however. Currently, the July put/call open interest ratio comes in at 0.75. This reading indicates that calls outnumber puts among short-term options, but is still rather high given Facebook’s sentiment history. Look for more bulls to jump on the bandwagon as FB stock reclaims $200.

Netflix (NFLX)

Netflix is bigger than cable. It’s official. Well, at least according to a recent survey from Cowen & Co. In the survey, Cowen asked 2,500 people “Which platforms do you use most often to view video content on TV?” Netflix was far ahead of the rest, with 27%. Cable came in at 20% with broadcast TV arriving third at 18.1%.

For reference, Amazon’s (NASDAQ:AMZN) Prime Video and the jointly owned Hulu streaming services both pulled less that 10% each.

Options traders didn’t miss NFLX’s dominance, and loaded up on call options. In fact, typically bullish calls made up 61% of the more than 137,000 contracts traded on NFLX yesterday. But, like many FAANG stocks, there is still a considerable degree of short-term negativity to work through.

Specifically, the July put/call OI ratio rests at 0.89. This reading is not historically high for NFLX — more middle of the road — but it does indicate that there is more room for optimism among options traders. That bullish sentiment could rise should NFLX take out technical resistance at $400.

General Electric Company (GE)

Ex-Dow component GE was a popular target for put options yesterday. Total volume on the stock rose to over 178,000 contracts, with puts claiming 58% of the day’s take. Traders were likely reacting to GE’s sharp rebound off technical support near $13.

This is somewhat confirmed by data from Trade-Alert.com. Specifically, a block of 42,400 GE July $12.50 puts were sold to open yesterday for a credit of 11 cents each, or $466,400 for the entire position. That’s a considerable payday, and the trader only needs GE to hold above $12.50 through July 20 to retain that chunk of change.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

Legendary Investor Louis Navellier’s Trading Breakthrough

Discovered almost by accident, Louis Navellier’s incredible trading breakthrough has delivered 148 double- and triple-digit winners over the last 5 years — including a stunning 487% win in just 10 months.

Learn to use this formula and you can start turning every $10,000 invested into as much as $58,700.

Click here to review Louis’ urgent presentation.

More From InvestorPlace

The post Friday’s Vital Data: Facebook, Netflix and General Electric Company appeared first on InvestorPlace.