FS KKR Capital (FSK) Q3 Earnings Top Estimates as Costs Fall

FS KKR Capital Corp.’s FSK third-quarter 2020 net investment income of 63 cents per share beat the Zacks Consensus Estimate of 61 cents. However, the bottom line was 29.2% below the year-ago quarter figure.

Results were hurt by fall in total investment income. However, lower expenses and decent portfolio activity during the quarter were tailwinds.

Net investment income was $78 million, down 32.2% from the prior-year quarter.

Total Investment Income & Expenses Decline

Total investment income was $147 million, down 26.1% year over year. The fall was mainly due to lower interest income and fee income. Also, the figure lagged the Zacks Consensus Estimate of $147.3 million.

Total operating expenses fell 17.9% year over year to $69 million. Lower management fees and the absence of subordinated income incentive fees were the main reasons for the decline.

Total Portfolio Value & Balance Sheet

The fair value of FS KKR Capital’s total investment portfolio was $6.65 billion as of Sep 30, 2020.

As of Sep 30, 2020, FS KKR Capital’s net asset value was $24.46 per share compared with $31.43 on Sep 30, 2019.

The company had $7.13 billion in total assets and $3.03 billion in total stockholders’ equity as of Sep 30, 2020.

Our Take

Decent origination volumes are expected to support FS KKR Capital’s profitability. However, a tough operating backdrop poses a concern.

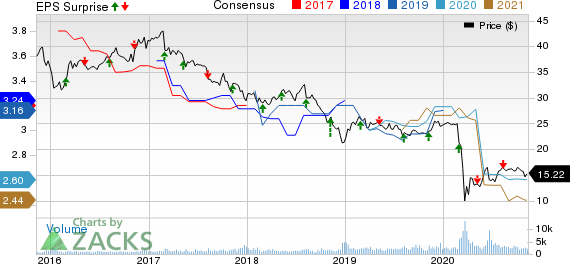

FS KKR Capital Corp. Price, Consensus and EPS Surprise

FS KKR Capital Corp. price-consensus-eps-surprise-chart | FS KKR Capital Corp. Quote

Currently, FS KKR Capital carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Hercules Capital Inc.’s HTGC third-quarter 2020 net investment income of 34 cents per share surpassed the Zacks Consensus Estimate of 32 cents. However, the bottom line declined 8.1% from the year-ago reported figure.

Ares Capital Corporation’s ARCC third-quarter 2020 core earnings of 39 cents per share beat the Zacks Consensus Estimate by a penny. However, the bottom line declined 18.8% year over year.

TriplePoint Venture Growth BDC Corp.’s TPVG third-quarter 2020 net investment income of 40 cents per share outpaced the Zacks Consensus Estimate of 36 cents. Also, the bottom line improved 38% from the year-ago quarter.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

TriplePoint Venture Growth BDC Corp. (TPVG) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research